Live Feed

The News Feed is curated by CGSP’s editors in Asia and Africa.

China Expresses ‘Serious Concern’ Over Israel Plan to Control Gaza

Solomon Islands Bars China and Taiwan From Top Pacific Summit

China Warns Against Gaza Occupation

Chinese Foreign Minister Pledges Support for Brazil in Tariff Fight

Indian Prime Minister to Visit China as Tensions with U.S. Rise

Indonesia’s Imports from China Hit $40 Billion, Surplus Persists

Vietnam Posts $10B Surplus in 2025, Deficit with China Hits $66B

Vietnam posted a $10.2B trade surplus in 2025, but a surging $66.5B deficit with China underscores deepening supply chain dependencies.

China Says Extends Probe Into Beef Imports

Independent Chinese Companies Drive Oil Investment Boom in Iraq

South Africa Explores China Connections as U.S. Tariffs Loom

Indonesia Taps Australian Lithium as China Builds EV Battery Plant

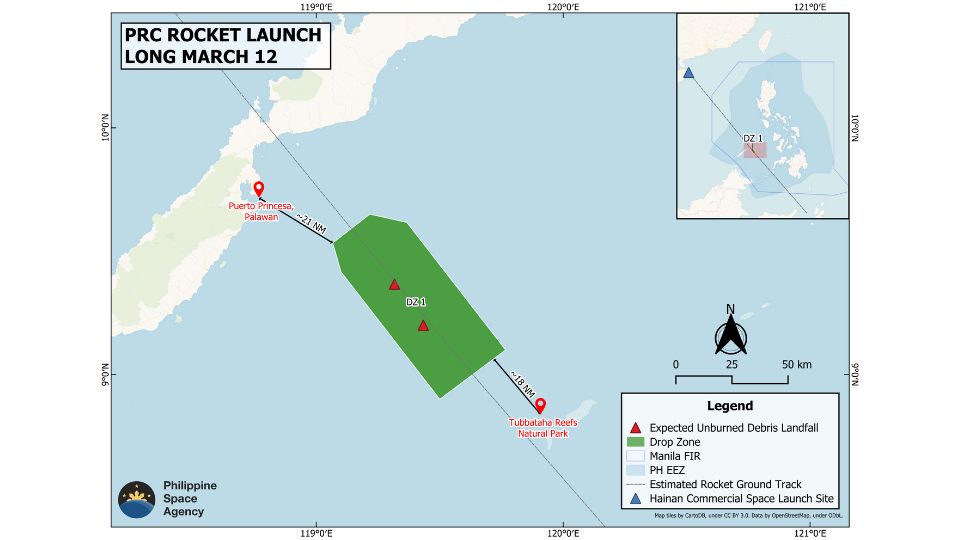

China’s Rocket Debris Prompts Philippine Condemnation

A Rosy Road Ahead? Chinese Documentary on EVs in Thailand Arrives as Doubts Mount

Why Milk Sank the Deal: A Chinese Scholar Explains the Cultural Clash Behind the U.S.–India Trade Breakdown

Philippines’ Marcos Strikes Defense Deals in India

Chinese Car Exports to Mexico and UAE Surge

Tariffs Forcing “China+1” Rethink

Philippines’ Marcos in India as Navies Hold Joint Drills

Zambian Documentary Slams Chinese Companies’ Environmental Record; Embassy Responds, Accuses Producers of “Hidden Motive”

New Video Surfaces of Congolese Soldiers Beating Miners at the Behest of Chinese Nationals

The Congolese human rights NGO Justicia Asbl released a shocking video on Sunday that was purportedly recorded on July 23rd, showing Congolese FARDC soldiers beating a trio of local miners with their hands bound at the behest of Chinese nationals.

The incident allegedly took place in the southeastern mining city of Kolwezi on July 23rd.

There's no additional information about who the Chinese nationals are standing in the background of the video and why they allegedly ordered the Congolese soldiers to beat the miners.

The Chinese embassy in Kinshasa has not commented on the video.

WHY IS THIS IMPORTANT? Several years ago, there was a flurry of these kinds of beating videos that appeared online, particularly from the DR Congo and Rwanda. Back then, these clips provoked massive outrage online with Chinese embassies quickly responding as well.

So far, reactions online to this video have been much more tempered, and the Chinese embassy seemingly more reluctant to respond, presumably waiting to see if the response escalates.

Pakistan Takes Delivery of Chinese Z-10ME Attack Helicopters

The Pakistani Army inducted a new fleet of advanced Chinese-made attack helicopters on Saturday, marking the first time the Z-10MEs have been put to use by a foreign military.

The Z-10ME is similar to the U.S.-made Apache AH-64 attack helicopter with all-weather, day/night capabilities.

Pakistani news reports claim around 40 of the new helicopters are now in service.

WHY IS THIS IMPORTANT? Pakistan sources more than 80% of its military hardware from China, a move that was once considered risky but is now seen as a distinct advantage given the benefits that come from interoperability.

Therefore, the addition of Z-10MEs into the force will likely be seamless given their ability to communicate and interface with other Chinese-made weapons and communications systems.

Coffee Exporters Look to China as U.S. Tariffs Redraw Trade Maps

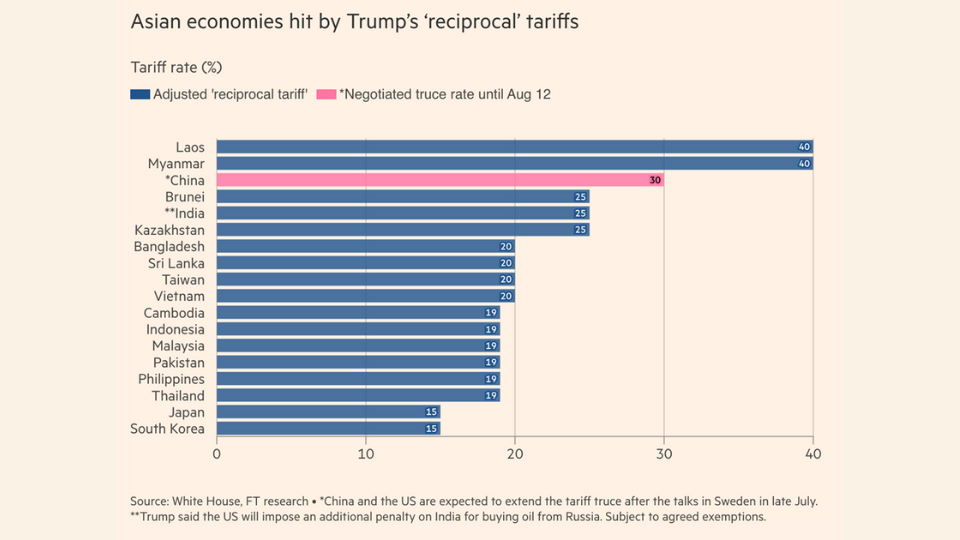

It's only been a few days since U.S. President Donald Trump unveiled a slew of new tariffs on the rest of the world, but already there are indications merchants in Asia, Africa, and the Americas are moving quickly to configure their trade flows to circumvent the United States.

In Africa, Citigroup’s Akin Dawodu said the tariffs are prompting companies and governments to find alternative trading partners, particularly in Asia and the Middle East.

“China is already the biggest overall trading partner for Africa, and second is the EU as a collective, and this trend could be accelerated,” Dawodu said. “Then there is also the Middle East that is increasingly coming into it, especially when it comes to food security.”

Coffee is going to be a leading indicator in this trend, especially in light of the new 50% tariff U.S. importers will now have to pay for Brazilian beans.

"The global coffee trade flow will be reshuffled. The pain will be felt from Sao Paulo to Seattle - from origin to roaster, to cafe chains, grocers, and morning commuters," said Michael J. Nugent, a senior U.S. coffee broker and owner of MJ Nugent & Co.

A lot of coffee exporters in both Brazil and Vietnam, the world's two largest producers, are now looking to China, in particular, to absorb some of the product that would otherwise go to the United States.

Beijing, for its part, appears to be eager to cooperate. On Saturday, the Chinese embassy in Brasília announced that 183 Brazilian coffee companies had just been approved to export to the Chinese market.

It's important, though, to keep expectations in check in terms of how much China can offset any declines in sales to the United States. While coffee consumption in China has grown steadily in recent years, on a per capita basis volumes remain relatively low compared to the U.S. and other Western markets.

WHY IS THIS IMPORTANT? There is very little awareness in the United States over how quickly global trade flows are reconfiguring to avoid the U.S., with many countries looking to China to offset their losses.

The irony, though, and we're going to first see this with coffee, is that Trump's tariffs stand a very good chance of bolstering China's role as the world's central trading power, while eroding the U.S.'s share of global trade.

Australian Police Charge Chinese National With ‘Foreign Interference’

Philippine, Indian Navies Begin First Joint South China Sea Patrols

China and Russia Start Joint Drills in Sea of Japan

Chinese Commentators Cheer Over Iran Ditches GPS for Beidou

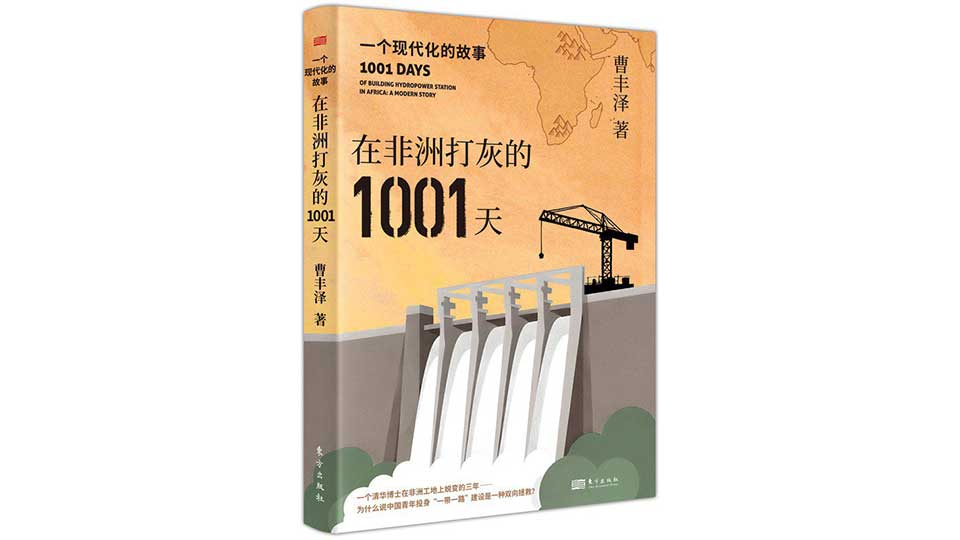

“1001 Days of Pouring Concrete in Africa”: A Chinese Engineer’s Memoir Sparks Debate Online

WEEK IN REVIEW: China, Russia Set Joint Sea 2025 Drills Near Japan

India and the Philippines to Launch Joint Military Exercises

Introducing CGSP Intelligence

CGSP Intelligence gives you the information advantage on Chinese activities in the Global South. CGSP Intelligence is launching in Summer 2025, with analysis and a full set of data tools designed for corporate and enterprise leaders.