Live Feed

The News Feed is curated by CGSP’s editors in Asia and Africa.

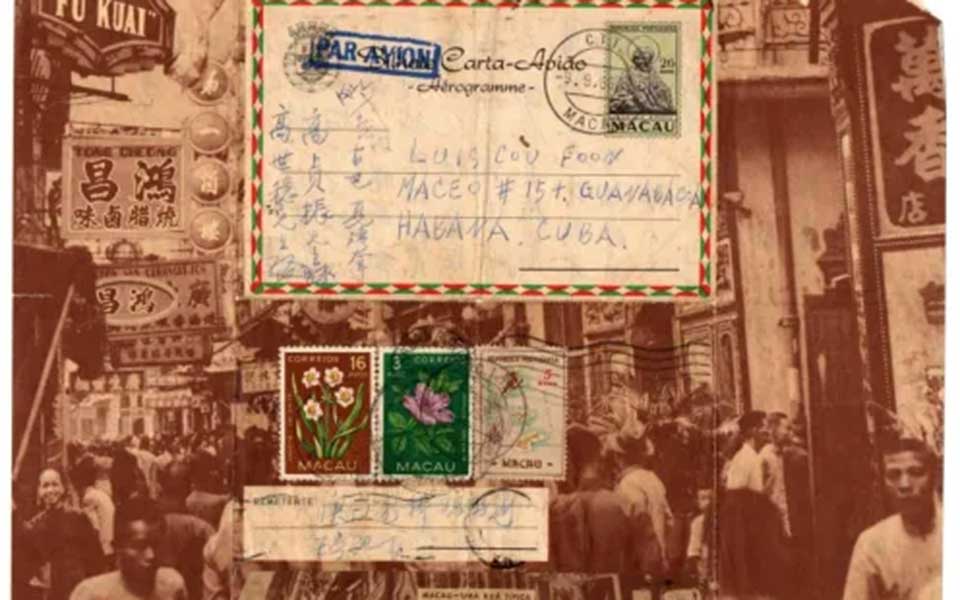

A Chinese Scholar Uncovers Cuba’s Chinese Migrant Past

Chinese Community Alarmed as Ex-Worker Kills Boss in Zambia – Latest in Disturbing Trend

Kenya or Tanzania? Chinese Investors in Africa Face a Clear Choice

Pakistan, Afghanistan Agree to Promote Regional Railway Project

Why China’s “Overcapacity” Looks Very Different in the Global South

A new Financial Times article about rapid changes in Pakistan’s electricity mix highlights how the large-scale production of solar panels and batteries in China, criticized as overcapacity by G7 governments, provides Global South countries the opportunity to rapidly expand their electricity supply and decarbonize their economies.

Pakistan was - and remains - heavily dependent on fossil fuels. Surging electricity prices and shaky supply caused Pakistani households and small businesses to import large numbers of Chinese photovoltaic panels, partly because competition in the Chinese solar market drove down prices. Pakistan imported a whopping 19GW in 2024 - enough to power 13,3 million households for a year.

The panels bridged power gaps but still left businesses affected by day/night cycles, while also stressing the larger grid. However, the rapid expansion of China’s battery manufacturing sector and the global slump in the price of lithium and other battery metals are now driving the adoption of Chinese-made battery storage systems across the country. Chinese smart grid technology is further aiding the transition.

The shift has been driven by middle-class consumers and businesses. This is putting financial pressure on the national grid as these relatively moneyed sectors withdraw their electricity payments, leaving poorer consumers dependent on a fraying grid. Meanwhile, problematic contracts with Chinese independent power producers are also adding to Pakistan's larger Chinese debt problem.

WHY IS THIS IMPORTANT? Pakistan’s reality, both the rapid uptake of Chinese technology and the resultant class divisions, is being replicated in other energy-poor countries, such as South Africa.

However, the fact that developing countries are using the scale of Chinese production to achieve the near-impossible feat of simultaneously closing power gaps while decarbonizing shows why G7 complaints about Chinese overcapacity and state subsidies for renewables make little sense in the Global South.

China Factory Activity Hits Lowest Since 2022, Survey Shows

Chinese Commerce Minister Visits South Asia

Wang Wentao, China’s Minister of Commerce led a large business delegation to Sri Lanka. Speaking at the Sri Lanka-China Trade and Investment Forum in Colombo during the weekend, Wang promoted a three-pronged strategy to strengthen ties: increased trade, expanded industrial investment and strengthening global multilateralism in the face of protectionism.

Wang also visited Bangladesh, where he met the country’s post-revolutionary leader Muhammad Yunus. Wang promoted cooperation on trade, e-commerce, agriculture, and fisheries. Yunus said his country’s villages hold untapped commercial potential and expressed hope that they’ll be turned into Chinese-style production units.

Philippine Defense Chief in Testy Exchange at Shangri-La Dialogue

Gilberto Teodoro, the Defense Secretary of the Philippines, got into a tense back-and-forth with Chinese officials at the Shangri-La Dialogue on Sunday. During a plenary session, two People’s Liberation Army officers asked him if Manila would adopt a friendlier attitude to China or serve as a U.S. proxy in Asia.

Teodoro thanked them for “propaganda spiels disguised as questions,” and went on to blast China, saying “the biggest stumbling block” to resolving the territorial issues in the South China Sea is a lack of trust in Beijing. Teodoro also said he can’t trust a country that “represses its own people.”

The exchange came as Australia’s Defense Minister Richard Marles demanded during another session that China explain its “extraordinary military buildup” in the region. The Philippines, Australia, Japan, and the U.S. released a joint statement pledging cooperation and regular ministerial meetings on regional security.

Meanwhile, Manila’s Foreign Affairs Secretary, Enrique Manalo, said his government is open to new arrangements via “dialogue and diplomacy” with China to resolve regional tensions. "If there is a possibility, I mean, I don't want to close the door, but it doesn't necessarily mean that we are following that track all the time," he said on the sidelines of a conference in Tokyo.

WHY IS THIS IMPORTANT? The tense exchange with the Philippine defense head arguably both hinted at regional tensions and pushed them closer to the boiling point.

U.S.-China Tensions Rise at Defense Dialogue

Global tensions ticked up this weekend as U.S. Secretary of State Pete Hegseth said China wants to “fundamentally alter” security relations in the Asia-Pacific region. Speaking at the Shangri-La Dialogue in Singapore on Saturday, Hegseth said possible Chinese action on Taiwan is “real and could be imminent.”

China’s Foreign Ministry hit back in a statement on Sunday, saying it “deplores” the comments and warned the U.S. to “never play with fire” on the Taiwan issue. The statement said: “No country in the world deserves to be called a hegemonic power other than the U.S. itself, which is also the primary factor undermining the peace and stability in the Asia-Pacific.”

Compared to previous sessions, China kept a low profile at this year’s Shangri-La Dialogue. China’s Defense Minister Dong Jun didn’t attend, and a customary session featuring Chinese defense bigwigs was this year replaced with one headlined by military universities. Dong’s absence also meant that no bilateral meetings took place on the sidelines.

WHY IS THIS IMPORTANT? The Shangri-La Dialogue is a key occasion for informal deal-making. China’s contained presence this year could be due to ongoing anti-corruption purges within the defense establishment, but it could also point to elevated regional tensions.

China’s Industrial Machinery and Mechanical Equipment Drives Indonesia’s Imports in 2025

Nearly four in ten non-oil imports entering Indonesia now originate from China, most of them industrial machinery.

In just four months, Chinese goods worth $25.7 billion entered Southeast Asia’s largest economy, underscoring China’s role as a key driver of the region’s infrastructure and manufacturing expansion.

Official data released Monday by Indonesia’s national statistics agency, Badan Pusat Statistik (BPS), confirmed that China remained the top non-oil and gas import partner for Indonesia from January to April 2025.

According to Pudji Ismartini, BPS Deputy for Distribution and Services Statistics, China contributed $25.77 billion in non-oil imports during the four-month period, up from $21.05 billion in the same period last year.

“China remains the primary country of origin for Indonesia’s non-oil imports, contributing 39.48% to total non-oil imports,” Pudji stated during the official release of the Berita Resmi Statistik on June 2.

Indonesia’s total imports during January–April 2025 reached $76.29 billion, marking a 6.27% increase year-on-year. Non-oil and gas imports climbed 9.18% to $65.29 billion, while oil and gas imports declined 8.27% to $11.00 billion.

In April alone, Indonesia’s imports surged 21.84% year-on-year to $20.59 billion, with non-oil imports jumping 29.86% to $18.07 billion, indicating heightened procurement of capital and industrial goods as the country advances infrastructure and factory buildouts.

Machinery and Electronics Lead Chinese Exports

China’s exports to Indonesia are dominated by industrial inputs. The top import category was machinery and mechanical equipment, valued at $5.81 billion, representing 22.53% of total Chinese non-oil exports to Indonesia.

Other major categories included Electrical machinery and equipment valued at $5.37 billion (20.84%), and Vehicles and parts, valued at $1.41 billion (5.46%)

These three groups alone comprised nearly half of all Chinese non-oil imports into Indonesia, highlighting the country’s dependency on China for hardware-intensive sectors such as construction, energy, transport, and automation.

Additional data from BPS showed that Indonesia’s total non-oil imports were also led by the same commodity classes. During January–April 2025, Indonesia imported machinery and mechanical appliances valued at $10.75 billion (1.38 million tons), electrical machinery and equipment valued at $9.35 billion (0.54 million tons), and vehicles and parts, valued at $3.45 billion (0.52 million tons)

Together, these accounted for 36.05% of total non-oil imports. All three categories showed increases in both value and volume from the previous year—evidence of accelerating industrialization and retooling.

A notable outlier was precious metals and jewelry, which recorded the highest year-on-year import surge across top categories, rising 253.57% to $2.06 billion, likely tied to investment or re-export trade. Conversely, organic chemicals saw the largest decline, falling 3.72% to $2.23 billion.

China Widens Lead in Regional Trade

Japan and Thailand followed as Indonesia’s second- and third-largest non-oil import sources. Japan’s share rose to 7.72% of total non-oil imports, valued at $5.04 billion, up from $4.31 billion last year.

Thailand’s contribution fell to $3.13 billion, down from $3.28 billion, now accounting for 4.79% of total non-oil imports. ASEAN countries excluding Thailand supplied $10.58 billion (16.21%), while the European Union accounted for $3.61 billion (5.53%).

“The highest increases in import value were recorded with China, Japan, and ASEAN excluding Thailand,” Pudji said. “Meanwhile, Thailand and the European Union experienced a decline.”

Imports from other regions comprised the remaining 31.06% of total non-oil trade.

BPS also provided a breakdown by end-use. During the first four months of 2025: Raw materials and intermediate goods rose 5.32% to $55.35 billion, capital goods surged 16.80% to $14.38 billion, while consumer goods declined 5.26% to $6.56 billion

This reflects Indonesia’s shift toward long-term industrial capacity building, with less emphasis on immediate consumption.

Indonesia Posts Trade Surplus, Driven by Non-Oil Exports

Despite the strong rise in imports, Indonesia maintained a trade surplus of $11.07 billion in the January–April 2025 period. This was largely driven by a non-oil surplus of $17.26 billion, which offset a $6.19 billion oil and gas deficit.

In April alone, Indonesia recorded a surplus of $0.16 billion, as non-oil trade yielded a $1.51 billion surplus, counterbalanced by a $1.35 billion oil and gas deficit.

On the export side, Indonesia shipped $87.36 billion worth of goods from January to April 2025, a 6.65% rise year-on-year. Non-oil exports increased 7.68% to $82.56 billion, led by industrial and agricultural products.

The largest non-oil export growth came from animal/vegetable fats and oils, which rose 26.97% to $2.11 billion, while mineral fuel exports dropped 18.50%, falling $2.39 billion from the previous year.

China was also Indonesia’s top non-oil export destination at $18.87 billion, followed by the United States ($9.38 billion) and India ($5.59 billion).

Combined, these three markets accounted for 40.99% of total non-oil exports. Exports to ASEAN reached $17.00 billion, and to the EU $5.91 billion.

Chinese Military Fans Discuss Why Indonesia Bought Rafale Instead of J-10C

How Apartheid Shaped U.S. Policy on South Africa: China Study

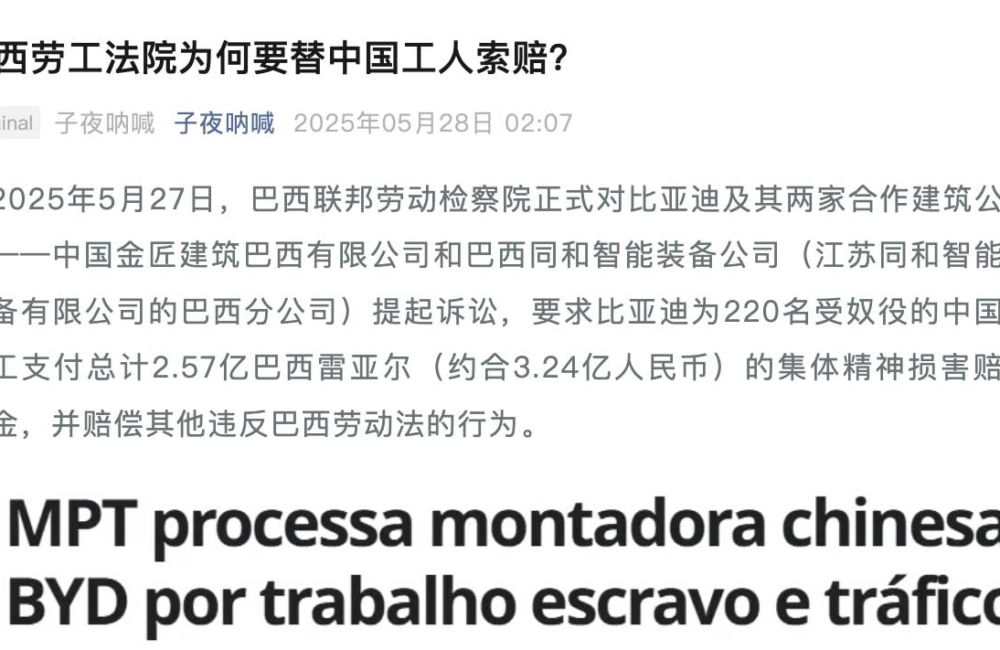

BYD’s Brazil Scandal Sparks Rare Self-Reflection in China

Pentagon Chief Warns China ‘Preparing’ to Use Military Force in Asia

By Ty McCormick

U.S. Secretary of Defense Pete Hegseth warned Saturday that China was "credibly preparing" to use military force to upend the balance of power in Asia, vowing the United States was "here to stay" in the Indo-Pacific region.

The Pentagon chief made the remarks at an annual security forum in Singapore, as the administration of U.S. President Donald Trump spars with Beijing on trade, technology, and influence over strategic corners of the globe.

Since taking office in January, Trump has launched a punishing trade war with China, sought to curb its access to key AI technologies, and deepened security ties with allies such as the Philippines, which is engaged in escalating territorial disputes with Beijing.

"The threat China poses is real and it could be imminent," Hegseth said at the Shangri-La Dialogue attended by defense officials from around the world.

Beijing is "credibly preparing to potentially use military force to alter the balance of power in the Indo-Pacific", he added.

Hegseth warned the Chinese military was building the capabilities to invade Taiwan and "rehearsing for the real deal".

Beijing has ramped up military pressure on Taiwan and held multiple large-scale exercises around the island, which are often described as preparations for a blockade or invasion.

The United States was "reorienting toward deterring aggression by communist China", Hegseth said, calling on US allies and partners in Asia to swiftly upgrade their defenses in the face of mounting threats.

Wake-Up Call

Hegseth described China's conduct as a "wake-up call", accusing Beijing of endangering lives with cyber attacks, harassing its neighbours and "illegally seizing and militarising lands" in the South China Sea.

Beijing claims almost the entire disputed waterway, through which more than 60 percent of global maritime trade passes, despite an international ruling that its assertion has no merit.

It has clashed repeatedly with the Philippines in the strategic waters in recent months, with the flashpoint set to dominate discussions at the Singapore defense forum, according to U.S. officials.

"China's assertiveness in the South China Sea has only increased in recent years," Casey Mace, charge d'affaires at the U.S. embassy in Singapore, told journalists ahead of the meet.

"I think that this type of forum is exactly the type of forum where we need to have an exchange on that."

But Beijing has not sent any top Chinese defense ministry officials to the summit, dispatching a delegation from the People's Liberation Army National Defense University instead.

Hegseth's comments came after Trump stoked new trade tensions with China, arguing that Beijing had "violated" a deal to de-escalate tariffs as the two sides appeared deadlocked in negotiations.

The world's two biggest economies had agreed to temporarily lower eye-watering tariffs they had imposed on each other, pausing them for 90 days.

But on Friday, Trump wrote on his Truth Social platform: "China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US," without providing further details.

Asked about the statement on CNBC, U.S. Trade Representative Jamieson Greer took aim at Beijing for continuing to "slow down and choke off things like critical minerals".

He added that the United States' trade deficit with China "continues to be enormous", and that Washington was not seeing major shifts in Beijing's behaviour.

Priority Theater

The Indo-Pacific is "America's priority theatre", the U.S. defense chief said, pledging to ensure "China cannot dominate us -- or our allies and partners".

He said the United States had stepped up cooperation with allies, including the Philippines and Japan, and reiterated Trump's vow that "China will not invade (Taiwan) on his watch".

But he called on U.S. allies and partners in the region to ramp up spending on their militaries and "quickly upgrade their own defenses".

"Asian allies should look to countries in Europe for a newfound example," Hegseth said, citing pledges by NATO members, including Germany, to move toward Trump's spending target of five percent of GDP.

"Deterrence doesn't come on the cheap."

Macron Urges Asia, Europe to Unite to Resist ‘Spheres of Coercion’

China Establishes Global Mediation Body in Hong Kong

WEEK IN REVIEW: Wang Yi Meets Over 50 African Envoys on Africa Day

Brazil Sues China’s BYD Over ‘Slavery’ Conditions on Build Site

No Top Defense Officials in China Delegation at Key Summit

China Says It Could Replace U.S. Funding in Colombia

China could step in to support infrastructure projects in Colombia if the United States withdraws funding, the country’s ambassador, Zhu Jingyang, said.

In mid-May, the US Bureau of Western Hemisphere Affairs said it would “strongly oppose” upcoming disbursements by the Inter-American Development Bank and other lenders for projects led by Chinese contractors in Colombia. This was a response to Colombian President Gustavo Petro pursuing closer relations with China.

Zhu said China and the BRICS-centric New Development Bank have $35 billion available to support more than 100 infrastructure projects in Colombia and Latin America. “China and other friendly countries have the capacity to finance,” he said on Tuesday.

China Offers Pacific Islands Climate, Development Cooperation

Indonesia, China Firms to Invest in EVs, Batteries, Data Centers

Indonesia's sovereign fund Danantara is coordinating with three to four unnamed Chinese companies to invest in EVs, batteries, and data centers, signaling a deepening of bilateral industrial alignment and an attempt to position Indonesia as a critical node in Asia's clean-tech value chain.

Indonesia is courting Chinese tech giants not for infrastructure loans or direct investment but for strategic co-investment in downstream industries.

“Maybe three to four are the leading ones. In terms of batteries, electric vehicles, they are interested. In terms of data centers, they are also very interested. In terms of consumer-side investment, they are also interested in that area. So we’ll see one by one,” said Pandu Sjahrir, CIO of BP Danantara, on May 25, 2025, after the Inaugural Global Business Summit on Belt and Road Infrastructure in South Jakarta.

Danantara Pursues Co-Investment Model

Pandu stated that Danantara is actively pushing for Chinese companies to establish plants in Indonesia, framing the move as a vehicle for “exchange of information and knowledge.” He confirmed that the companies will collaborate with Danantara across several sectors but declined to name them.

“There will be an announcement next week. Seems like in the next couple of days there will be an announcement. Please wait,” he said, adding that the announcements will be staggered. “One by one. If it's too fast, it won’t work. One by one we will announce [the partnerships with China].”

Beyond the initial companies, Pandu indicated further collaboration with China on energy security, digital security, and downstream industrial development. “China already has significant downstream investment. Danantara will invest together here as well. We will put in capital here,” he said.

On nickel-related downstream investments, Pandu stated, “Many Chinese companies want Danantara to co-invest in building the EV ecosystem, which includes battery facilities and EV production itself.”

“This is good for Indonesia, not only for the domestic market, which is currently growing well in the EV space. It can also be for export. So this can make Indonesia a central hub for EVs,” he said.

Firms Plan Long-Term Relocation

According to Mahardi Tunggul Wicaksono, Director of the Maritime, Transportation Equipment, and Defence Equipment Industry (IMATAP) at the Indonesian Ministry of Industry, several automotive companies from China and Europe are expressing strong interest in investing in Indonesia’s electric vehicle and battery sectors.

He stated that this interest has been partly triggered by U.S. import tariffs, which have led companies to adjust their strategies. He noted that trade tensions, including tariff wars, do not always produce negative consequences; instead, they have prompted a wave of companies to consider relocating or expanding operations in Indonesia.

The investment value remains under discussion. However, the companies involved have long-term plans and are preparing to shift portions of their existing operations to Indonesia.

China–Indonesia Launch Investment Fund Plan

Mango Deal Sweetens Ties Between Bangladesh and China

Bangladesh waved off its first consignment of mangoes to China on Wednesday, a largely symbolic export as Beijing seeks to sweeten ties after relations soured between Dhaka and its former ally and neighbor, India.

Bangladesh, still reeling from the political fallout of a 2024 uprising that ended the autocratic rule of Sheikh Hasina -- who fled by helicopter to New Delhi -- has since been courted by Beijing, India's rival.

"It is such a great pleasure to jointly witness this historic moment, as the first consignment of Bangladesh's premium mangoes sets off for China," China's ambassador to Bangladesh Yao Wen said, alongside government officials.

Bangladesh, largely encircled by land by India, has seen relations with New Delhi turn icy.

Interim Bangladeshi leader Muhammad Yunus's first state visit was to China, while Bangladesh has also moved closer to Pakistan, India's arch-enemy.

"President Xi Jinping has emphasised on several occasions that China's door of opening up will not close, but will only open wider," Yao said, at a small ceremony at the airport alongside Bangladeshi ministers.

"I am confident that the export of Bangladeshi mangoes to China is just the beginning," he added.

In China, the fruit has a particular historical diplomatic resonance, including the curious cult of the mango.

After Chairman Mao Zedong was pictured gifting a mango to a group of workers in 1968, during the mania of the Cultural Revolution, the fruit became an object of veneration.

Those mangoes were reportedly a gift from the foreign minister of Pakistan -- and at that time, in 1968, Bangladesh had yet to win its independence from Islamabad.

Export levels are small so far, just 50 tonnes in an initial phase, but both Bangladesh and China said they hoped to increase that.

In the past year, China has sponsored several tours for Dhaka's political party leaders and has begun hosting Bangladeshi patients in its hospitals.

India has long been wary of China's growing regional clout, and the world's two most populous countries compete for influence in South Asia, despite a recent diplomatic thaw.

Peru Seeks Rail Meeting with China, Brazil

ASEAN Unveils Its Anti-Tariff Toolkit

In a joint statement released on Monday, the Association of Southeast Asian Nations (ASEAN) repeated its rejection of current U.S. trade restrictions. The ten-country group listed the following countermeasures:

- Increase trade and investment among ASEAN members and upgrade overarching trade policies.

- Upgrade and leverage existing external trade links. These include ASEAN Plus One free trade agreements with individual countries, trade within the China-centric Regional Comprehensive Economic Partnership (RCEP) bloc, and building new linkages, especially with the Gulf Cooperation Council.

- Upgrade internal coordination via the newly formed ASEAN Geoeconomic Task Force.

- Use national countermeasures to protect member states’ industries against tariffs.

WHY IS THIS IMPORTANT? In its conservative way, the ASEAN summit and the body's linked summit with China and Middle Eastern powers hint at how key global economic actors see a post-U.S. trade landscape.

French President’s Southeast Asia Tour Draws Skepticism on Chinese Social Media

Chinese Netizens View Post-Assad Syria With Distrust and Geopolitical Alarm

China Not Trying to ‘Replace’ U.S. in Colombia: Ambassador

China is not seeking to "replace" the United States as the top trading partner of Colombia, Beijing's ambassador to Bogota, whose president has announced a pivot to China, told AFP on Tuesday.

Until recently Colombia was one of the United States' closest trade and security partners in Latin America.

But the country's first leftist president Gustavo Petro, who has crossed swords with his U.S. counterpart Donald Trump, is trying to steer more trade towards China.

China's ambassador to Bogota denied that Beijing was seeking to topple the United States from its pole position in Latin America.

"China is coming to offer our collaboration, not to replace anyone, nor seeking to take someone's place," Zhu Jingyang told AFP on the sidelines of a media briefing.

Earlier this month, Colombia formally joined China's vast Belt and Road (BRI) infrastructure program.

Bogota's accession boosted Beijing's efforts to deepen ties with Latin America, a key battleground in its confrontation with the Trump administration.

It came in the wake of a showdown between Trump and Petro over deportation flights, which ended in humiliation for Colombia.

After initially denying entry to US military planes carrying deported Colombians in January, Bogota sent its own planes to bring them home to avoid hefty US tariffs threatened by Trump.

The business community in Latin America's fourth-biggest economy has expressed fears that Petro's rapprochement with China could damage Colombia's trade with the United States.

The State Department's special envoy for Latin America, Mauricio Claver-Carone, warned recently that the United States might start buying flowers and coffee -- two of Colombia's top exports to the United States -- from other Latin American countries instead.

Zhu accused the Trump administration of using "intimidation" and "blackmail" to try to keep Colombia in its orbit.

Two-thirds of Latin American countries have already joined the Belt and Road Initiative.

Introducing CGSP Intelligence

CGSP Intelligence gives you the information advantage on Chinese activities in the Global South. CGSP Intelligence is launching in Summer 2025, with analysis and a full set of data tools designed for corporate and enterprise leaders.