Live Feed

The News Feed is curated by CGSP’s editors in Asia and Africa.

China Protests Illegal Fishing Accusations

China is furiously protesting claims that its distant water fishing fleets are involved in rampant illegal, unreported, and unregulated (IUU) fishing in waters as far away as South America.

This follows a report by the U.S. National Oceanic and Atmospheric Association (NOAA) that gave China, Russia, and Mexico negative certifications for IUU fishing and singled out China and Taiwan for using forced labor in their fishing operations.

The report kicks off a two-year review period and could culminate in import bans and barred access from U.S. ports.

In response, China’s State Council Information Office released a white paper charging that China has ‘zero tolerance’ for illegal distant water fishing activities, that monitoring of Chinese distant fleets is more stringent than international standards, and that China abides by rules for how many tons of fish can be caught.

Foreign Ministry spokesperson Mao Ning called the NOAA report "nothing but political manipulation" that will disrupt global cooperation on fisheries. Meanwhile, foreign diplomats were toured around fishing facilities in Fujian province to rebut the claims.

Despite all these denials, there is a long record of bad practices by Chinese distant fishing fleets. A 2022 report by the Financial Transparency Coalition found that ten global companies are responsible for a quarter of IUU fishing incidents, and eight of those ten are Chinese (the other two are from Spain and Colombia.)

Developing countries are suffering massive losses, with Ghana’s Environmental Justice Foundation showing that 90% of the overfishing causing the collapse of fishing economies on Ghana’s coast is due to Chinese-owned industrial vessels.

WHY IS THIS IMPORTANT? Industrial fishing is a scourge on coastal communities throughout the Global South and a major factor in environmental collapse. China is only one of many countries involved in this practice.

SUGGESTED READING:

Xinhua: Full Text: Development of China’s Distant-Water Fisheries by China State Council Information Office

SeafoodSource: China Responds to IUU Charge by Taking Diplomats on Tour of Fishing Facilities by Mark Godfrey

Thai Land Bridge Project (Possibly) Gets Chinese Interest

Thai officials say the Chinese construction giant China Harbor Engineering Company (CHEC) expressed interest in a project touted by the Thai government that would build double deep-sea ports in Chumphong and Ranong, linked by road, rail, and pipelines to connect the Gulf of Thailand and the Andaman Sea.

Thai Prime Minister Srettha Thavisin promoted the project at last week’s Belt and Road Forum. While no confirmation came from CHEC, Thai spokesperson Chai Wacharonke said that CHEC Chairman Wang Tongzhou responded positively during a meeting with the PM.

The Thai government will reportedly promote it to investors from November to January and land expropriation is expected to start in April to June 2025, with winners announced in August 2025 and construction starting in September.

Thailand hopes the project will turn it into a global hub by rerouting traffic from the Straits of Malacca, one of the world’s busiest shipping lanes. For China, the stakes are even higher: the Straits of Malacca is its most direct route to the Middle East and a major conduit for oil and gas. However, in the event of a conflict with the United States, the route could easily be blocked putting China in a double energy and trade bind.

The Thai land bridge offers a potential solution to this dilemma, but it comes with its own challenges…

- WHY THIS IS A GOOD IDEA: The land bridge will shorten the time it takes to ship goods through the Malacca Straits by six to nine days. It will also draw significant investment to Thailand. In theory, it would be more feasible than the long-touted plan of digging a canal through the 90-kilometer Kra isthmus. It will also integrate China more deeply into the Southeast Asian economy, in line with other cross-land logistics routes.

- WHY THIS IS A BAD IDEA: The project will be costly (between $27 billion and $35 billion) and complicated due to the mountainous terrain. It will also likely set off conflicts with separatist movements in Thailand’s restive south while drawing Thailand closer to simmering territorial issues in the South China Sea. The route will also put Thailand in competition with very well-developed shipping hubs like Singapore.

WHY IS THIS IMPORTANT? If Thailand pulls it off, the land bridge could be a geopolitical and trade game changer, significantly shifting strategic planning around China’s connections to the world.

SUGGESTED READING:

- CNA: Analysis: Thailand’s Proposed Land Bridge Project Easier Than Kra Canal Idea, But Steep Challenges Await by Pichayada Promcherchoo and Rhea Yasmine Alis Haizan

- Vietnam Plus: Chinese Firm Interested in Thai Land Bridge Project

Africa-China Meetings Give Glimpse of Next Year’s FOCAC Agenda

Mexico and China In Talks to Curb Fentanyl Trade

Mexico and China are reportedly discussing how to control the flow of ingredients used to make fentanyl. The deadly opioid is about fifty times stronger than heroin and causes numerous overdoses in the United States per year.

Despite Mexico and China denying culpability, political pressure from the U.S. prompted conversations between Beijing and Mexico City, which could spark a high-level meeting. The first step to curbing the flow would reportedly be intelligence-sharing about the shipping of precursor chemicals and finished drugs from China to Mexico.

The issue has caused a complex three-way fight between China, Mexico, and the U.S. China is accused of supplying the precursor chemicals used to produce fentanyl in Mexico, which is then smuggled into the U.S.

The Different Sides of the Fentanyl Fight:

- U.S.: Fentanyl has become an election issue, with politicians like Republican Senator Lindsey Graham threatening to designate groups producing the drug as foreign terrorist organizations and Republican Presidential candidate Ron DeSantis vowing to send the military into Mexico to stem the trade. Mexican President Andrés Manuel López Obrador rejected the war talk. Meanwhile, the U.S. has also sanctioned Chinese companies and individuals accused of involvement in the trade. The US Drug Enforcement Administration stated that China is “the main source for all fentanyl-related substances trafficked into the U.S.”

- CHINA: Beijing has so far rejected these accusations. In response to U.S. Attorney General Merrick Garland’s charge that “We know that this global fentanyl supply chain, which ends with the deaths of Americans, often starts with chemical companies in China,” Liu Pengyu, a spokesperson for the Chinese embassy in Washington, said the U.S. is ‘scapegoating’ China. In 2019, China declared fentanyl and some of its precursor drugs controlled substances, following requests from the Trump administration. However, this direct control ended up causing more of the trade to flow through Mexico.

- MEXICO: The China-Mexico talks would be a step forward after months of Beijing denying that the trade existed. President Obrador offered in March to provide China with intelligence about the trade following the discovery of a shipping container from China with the drug. Mexico has requested greater harbor surveillance by the Chinese authorities. Meanwhile, Obrador also denies that fentanyl is produced in Mexico, saying it is imported as a finished product from Asia.

WHY IS THIS IMPORTANT? Fentanyl is shaping up as a key issue in the 2024 election, and it is likely to be framed through a geopolitical lens by candidates eager to look tough on China. The talks between China and Mexico represent a rare step towards cooperation in dealing with the problem.

SUGGESTED READING:

- Bloomberg: Mexico and China Seek to Stem Fentanyl’s Deadly Cross-Pacific Flow by Max de Haldevang

- AFP: Mexico Says It Will Give China Proof of Fentanyl Smuggling

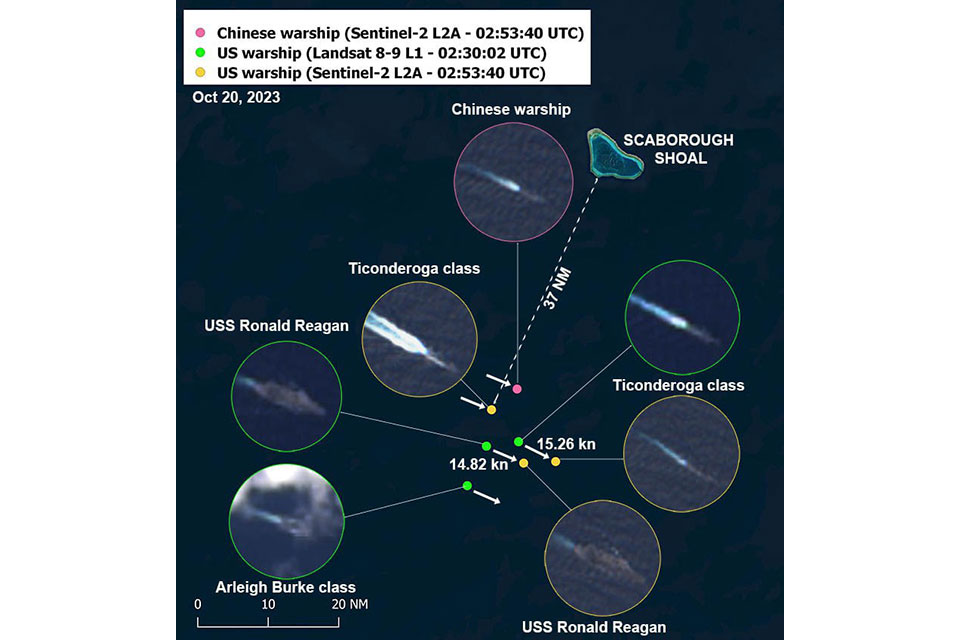

U.S., China Both Operating Carrier Strike Groups in the South China Sea

China Comes to Philippines Confrontation With Cameras Ready

China Limits Exports of Graphite to Counter U.S. Technology Restrictions

The Chinese government announced it will soon restrict the export of three grades of graphite, a key ingredient in EV batteries and nuclear power plants, in retaliation for U.S.-led restrictions on technology sales to Chinese companies.

China's Ministry of Commerce and the Customs Administration said in a joint statement on Friday that the new export controls will go into effect on December 1st and were introduced on "national security" grounds.

These latest restrictions are similar to those imposed in August for the chip-making metals gallium and germanium.

While Chinese authorities were upfront in acknowledging the new graphite measures are a direct response to last week's move by the Biden administration to limit sales of advanced semiconductors to Chinese companies, Beijing also wanted to make it clear the move is not part of an effort to weaponize the EV battery metal supply chain.

Those assurances, though, will probably come as little comfort to both policymakers and automakers in G7 countries that have become increasingly concerned China is willing to leverage its dominance in both mining and refining of critical minerals used to make EV batteries and other technologies.

Like so many of the other metals and minerals in the EV battery metal supply chain, China is by far the dominant actor in the graphite sector, where it produces 70% of the world's supply.

Reaction to China's New Graphite Export Controls

- LOOK FOR NEW SUPPLIERS: "Graphite markets have been in oversupply, with falling prices, so the export licenses don’t make sense from a market standpoint. They will worry the West, however, and be a boon to up-and-coming producers outside China" -- Andy Leyland, CEO of Supply Chain Insights (REUTERS)

- NOT A FULL BAN BUT...: "It would be a bold step to cut off the world from graphite because I think the Chinese know that would bring EVs to a halt everywhere and probably would create escalation rather than de-escalation of some of the trade disputes going on with China - between the EU and China, between the U.S. and China" -- Christopher Richter, Deputy Head of Research at CLSA in Tokyo (EURONEWS)

- MEASURES NOT AIMED AT U.S.: "I believe that the decision to adjust these measures is solely based on the development of the industry, without any other consideration to target a third party. We must learn from China's experience with rare earths, and not excessively exploit and export them at low prices" -- Sun Qing, Honorary President of the China Carbon Industry Association (GLOBAL TIMES)

WHY IS THIS IMPORTANT? Developing countries that export the raw materials used to manufacture EV batteries could benefit a lot from these escalating supply chain tensions between G7 countries and China:

- Any new restrictions on these commodities could help boost prices for graphite and other critical resources, including nickel, cobalt and lithium, which have all been in the doldrums for the past year.

- G7 countries are going to be more determined now to find alternate suppliers for these resources that could drive a lot of new investment in both mining and refining in countries with abundant supplies of these metals.

SUGGESTED READING:

China Takes Advantage of Cobalt’s Low Price to Boost Strategic Reserve

The Chinese government plans to fortify its stockpile of cobalt, a critical resource used to manufacture electric vehicle batteries.

Insiders tell Reuters that the Strategic Reserves Administration plans to purchase 3,100 metric tons of the blue metal in a move likely timed to take advantage of a prolonged market downturn for cobalt.

Prices today are at around half of what they were a year ago.

While other major economies like the U.S. have strategic reserves for oil, China maintains similar reserves for a number of key commodities, including wheat, copper, aluminum, zinc and cobalt.

China's current cobalt reserve is estimated to be between 5,000-7,000 metric tons but it's difficult to know the precise quantity since the government does release that kind of information.

WHY IS THIS IMPORTANT? China's cobalt reserve is potentially problematic for Beijing's G7 rivals that want to build alternate supply chains for EV battery metals. Those advanced economies, though, are all relying on private mining companies that are price sensitive.

So, China has an incentive to keep the price of cobalt and other battery metals low in order to keep their challengers out of the market and challenge Beijing's firm grip on the supply chain.

And if the price goes up to the point where Canadian, U.S. and Japanese mining companies, among others, want to get into the market, the Chinese have the option to push them out by releasing some of their strategic reserves to suppress the price.

SUGGESTED READING:

- Reuters: China's state reserve expected to buy 3,100 T of cobalt - sources

- Bloomberg: China Set to Boost State Cobalt Reserves After Tumble in Prices by Annie Lee and Alfred Cang

China’s Special Mideast Envoy Largely Unseen at Cairo Peace Conference

What is China Trying to Achieve in the Middle East? Prominent Chinese Scholar Lays it Out

Pentagon Report Shows Not Much Has Changed in Chinese Military Engagement in the Global South

The Pentagon has issued its annual report on China’s military capability. While it notes an increase in China’s overall military strength, especially how fast it’s building up its nuclear arsenal, not much has seemingly changed in terms of China’s military expansion in the Global South.

The report projects that China will have more than 1,000 nuclear warheads by 2030 (up from about 500 today and 400 in 2021.) It also says China is exploring conventionally armed intercontinental missile systems. If developed, these could allow it to target the United States.

However, in terms of Chinese engagement in the Global South, the report notes relatively few changes compared to the year before.

Highlights of Pentagon's 2023 Report on Chinese Military Engagement in Global South

- BASING: “In June 2022, a PRC official confirmed that the PLA would have access to parts of Cambodia’s Ream Naval Base. The PRC probably also has considered other countries as locations for PLA military logistics facilities, including Burma, Thailand, Indonesia, Pakistan, Sri Lanka, United Arab Emirates, Kenya, Equatorial Guinea, Seychelles, Tanzania, Angola, Nigeria, Namibia, Mozambique, Bangladesh, Papua New Guinea, Solomon Islands, and Tajikistan.” Nigeria, Mozambique and Bangladesh were added since the previous report, while Singapore and Vanuatu disappeared from the current list.

- MILITARY INFRASTRUCTURE: Very few new developments are noted relating to Chinese military infrastructure in the Global South. For example, wording in the 2022 report that: “In late March 2022, a Type 903A “Fuchi” class supply ship, Luomahu (AOE-964), docked at the 450-meter pier for resupply; this was the first such reported PLA Navy port call to the Djibouti support base, indicating that the pier is now operational. The pier likely is able to accommodate the PLA Navy’s aircraft carriers, other large combatants, and submarines,” is simply repeated in 2023.

- UKRAINE: The 2023 report argues that “Diplomatically, the war in Ukraine probably has reaffirmed to Beijing the importance of persuading Global South countries in Africa, Latin America, the Middle East, and the Indo-Pacific to echo China’s narratives on the conflict. The PRC probably views support from the developing countries as crucial to blunting U.S.-led efforts imposing reputational and economic costs on the PRC as well as claiming broad international support for PRC goals.”

WHY IS THIS IMPORTANT? While concern about China’s influence in the Global South remains high in Washington, the report also shows that there hasn’t been much movement on this issue over the last year, with almost identical talking points about Cambodia, Djibouti and other regions coming up.

SUGGESTED READING:

- U.S. Department of Defense: Military and Security Developments Involving the People’s Republic of China 2023 [PDF]

- Reuters: What Is Most Significant in the Pentagon’s China Military Report?

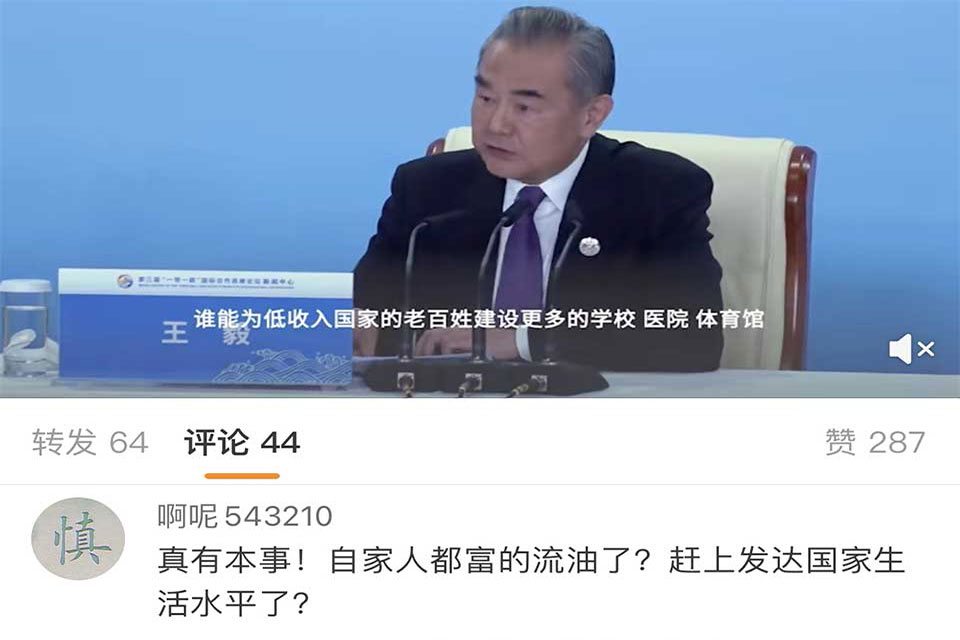

Chinese Netizens Hit Out At Wang Yi’s Infrastructure Challenge

African, Chinese Exim Banks Sign $600 Million Trade Deal

China Exim Bank has signed a $600 million deal with the African Export-Import Bank to boost trade and economic cooperation between Afreximbank member states and China.

At present, it is unclear which specific sectors will be targeted via the deal, which was signed by China Exim’s Vice President Zhang Wencai and Afrexim’s Executive Vice President George Elombi.

Meanwhile, the China Exim Bank Chair Wu Fulin met with an Ethiopian delegation on the sidelines of the Belt and Road Forum last week to discuss the disbursement of about $1.3 billion in loans that were frozen as part of a Chinese review of Ethiopian debt sustainability.

The freeze came as Ethiopia slid into debt distress due to the pandemic and a civil war. China recently approved a one-year debt servicing pause.

China’s Foremost Mideast Scholar Explains Beijing’s Response to the Israel-Hamas War

Kevin Gallagher’s Key Takeaways From the Belt & Road Forum

Boston University Global Development Policy Center Director Kevin Gallagher was one of only a handful of U.S. stakeholders invited to participate in the Belt and Road Forum that just wrapped up in Beijing.

Kevin joined CGSP Editor-in-Chief Eric Olander for a quick 5-minute debrief to discuss what the news didn't cover and why he was surprised by some of the announcements.

Xi Meets with Kenyan, UN, Nigerian Leaders

Wang Yi to Challenges Western BRI-Rivals: Bring it On

Vietnam Sentences Trafficking Ringleaders That Sold Brides in China

A court in Vietnam sentenced six women to up to 30 years in jail for running a trafficking ring that sold women and girls to China as wives — a problem that has plagued Southeast Asia for years.

China’s gender imbalance and tradition of rural men paying for brides have made the country a locus of female trafficking. Besides Vietnam, most women trafficked into China come from Myanmar, Cambodia, North Korea, and Pakistan, according to Human Rights Watch.

There is hope that the end of China's one-child policy may help minimize its gender imbalance and in turn, reduce trafficking. Still, experts say that could take years and that in the meantime, government policy to address the problem is sluggish.

In the latest Vietnam case, the group came together initially as acquaintes on a social network that matches Vietnamese women with foreign men, mainly from China.

This eventually grew into a system of tricking poor rural women into paying for the promise of a stable future in China and financial payments to their families remaining in Vietnam.

WHY IS THIS IMPORTANT? China’s footprint in many areas is felt far beyond its borders. Its demographic problems are just one example of its domestic issues spilling over into neighboring countries.

SUGGESTED READING:

- VN Express: Six Jailed for Selling Women to China as Wives by An Minh

- The Diplomat: China’s Bride Trafficking Problem by Heather Bar

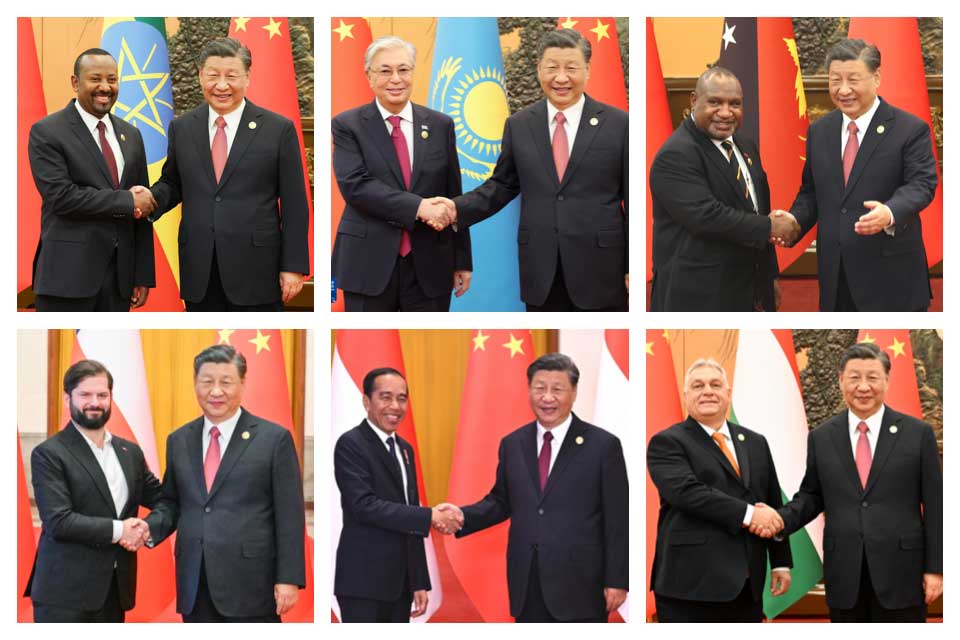

Xi’s Speed Diplomacy on the Sidelines of the Belt and Road Forum

The Number of Leaders Attending China’s Belt and Road Forums Has Fallen Steadily

Kenya’s President Appeals to Chinese Investors to Finance Railway Extension to Ugandan Border

Kenyan President William Ruto issued a direct appeal to Chinese investors to finance the extension of the Standard Gauge Railway (SGR) to the Ugandan border.

The president explained that completing this last portion of the railway would unlock significant economic opportunities throughout East Africa.

“The reason why we are discussing with China is we want to connect the eastern coast [of] Africa to the western coast of Africa,” he told a packed auditorium at the Kenya-China Investment Forum in Beijing that took place on Tuesday on the sidelines of the Belt and Road Forum.

The president added that leaders from Congo-Brazzaville, DR Congo and Uganda are all behind the effort.

But it's going to be a tough sell, though.

China had originally planned to finance the railway all the way from the Port of Mombasa to the Ugandan border but then balked when the project's costs ballooned beyond $6 billion.

Despite repeated pleas from Kenya to finance the last phase of the railway that stopped in the middle of a largely rural area in the Rift Valley, Chinese creditors held firm and refused.

Now, the president wants to use a public-private partnership to finance the extension similar to the model used with the China Road and Bridge Corporation to build the 27km Nairobi Expressway.

WHY IS THIS IMPORTANT? The original idea of the SGR was to serve as a giant funnel that would facilitate cargo transport to/from across East Africa to the Port of Mombasa. But that never happened because it dead-ended in Naivasha -- dubbed the "Middle of Nowhere."

The president has got to find a way to get this last part of the project financed so he can boost the railway's revenues and pay down the billions owed to Chinese creditors.

SUGGESTED READING:

- Nation: President Ruto pitches for SGR linking African's east and Western coasts by Aggrey Mutambo

- Citizen Digital: Kenya Seeking Funds To Extend SGR To Malaba by Francis Mtalaki

Ethiopia-China Ties Upgraded

Argentinian President Leans Into China Ties while Dissent Brews at Home

The Old Belt & Road is Over, New Era Begins, Says Top China Analyst Richard McGregor

With the Belt and Road Forum in Beijing now wrapped up, some of the world's top China analysts are beginning to reflect on the key themes that emerged at this year's event and what it says about the future of Belt and Road.

Richard McGregor, a senior fellow at the Lowy Institute in Australia and a prominent China journalist/author, told CNBC on Tuesday that it's evident the Belt and Road as we know it, is now over:

This meeting is sort of backward looking and forward looking. It's backward looking in this respect: the BRI, as we know it, is basically over and we're moving into a new era these days where it's smaller, quality over quantity...

Most of the countries that China has lent to can't borrow anymore. So, they're not going to do big projects. China's issue now with many BRI countries [like] Uganda Zambia, Sri Lanka, Laos and some islands in the Pacific is how to pay the money back not to borrow more money. So, that big part of the BRI is over.

We're now moving to a new era where China is putting its ideas for an alternative world order on top of what it's done with the BRI, Global Development Initiative, Global Security Initiative and the like, and you see that in the meeting in Beijing at the moment.

Watch the full interview with Richard McGregor on CNBC's YouTube channel.

Philippines-China Rail Cooperation In Crosshairs as Maritime Tensions Escalate

The Philippines is in a juggling act as tensions with Beijing escalate in the South China Sea but the countries remain engaged in multiple infrastructure projects.

The two sides recently updated a Belt and Road deal prioritizing construction of two bridge projects and the Philippines Department of Transportation said in August China was the “best option” for funding three major railway projects.

But in recent weeks, the two sides have clashed in disputed territorial waters. China recently even deployed a navy vessel that undertook what Manila called “dangerous maneuvers and aggressive actions” days after a Philippines navy ship transited the area.

China, as recently as Monday, accused the Philippines of violating its sovereignty in the region.

The next day, the Philippine National Railways (PNR) general manager, Jeremy Regino, said he was weighing other options for funding one of the main railway projects as Chinese negotiations remain pending.

That new funding could come from foreign government official development assistance, the private sector, and Manila itself.

WHY IS THIS IMPORTANT? What had been a relationship with areas of occasional territorial disputes but economic cooperation could further sour into bilateral disengagement.

With little or no financial incentives to remain cordial with Beijing and both navies now involved, future South China Sea disputes could become more hostile or even edge toward activation of the U.S.-Philippines Mutual Defense Treaty.

SUGGESTED READING:

- Philippine Daily Inquirer: PNR Weighs Other Funding Options for P142-B South Long Haul Project by Tyrone Jasper C. Piad

- Global Times: Philippines Condemned for Serious Violation of China's Sovereignty in S.China Sea

Ethiopian Prime Minister Meets China’s Premier

Ethiopian Prime Minister Abiy Ahmed held talks with Chinese Premier Li Qiang in Beijing on Monday. The PM is on an official visit to China and will attend the Belt and Road Forum.

In the Xinhua readout of the meeting, Li is quoted as saying that China will increase imports from Ethiopia and encourage Chinese investment in the country.

During the 2010s, Ethiopia was seen as a key example of Chinese-led manufacturing in Africa. The presence of Chinese garment and shoe assembly plants in Chinese-built Special Economic Zones was seen as an example of a Chinese-style mass production model taking root in Africa.

The Ethiopian civil war and the COVID crisis helped to derail that narrative. Ethiopia is one of the countries in Africa holding the most Chinese debt. In 2021, it applied for debt relief under the G20’s Common Framework.

China indicated in August it would allow Ethiopia to suspend debt repayments for the fiscal year ending July 2024.

However, this week Ethiopia's state finance minister, Eyob Tekalign Tolina, said a broader debt deal with the IMF is stuck due to the ongoing fallout of the civil war. Despite a ceasefire agreement in November 2022, widespread violence continues. Tolina said he hopes there will be peace talks in the “coming few weeks.”

China likely helped to facilitate Ethiopia joining the BRICS and new investment deals announced at the Belt and Road Forum likely signal a slight uptick in relations.

WHY IS THIS IMPORTANT? Ethiopia was a staunch partner of China throughout its COVID shutdown and the recent announcement that Ethiopian Air is back to its pre-pandemic flight schedule to China could be a sign of normalization.

SUGGESTED READING:

- Xinhua: Chinese Premier Holds Talks with Ethiopian PM

- Reuters: Ethiopia Seeks Debt Relief from Other Creditors After China, IMF Official Says by Rachel Savage

The Belt and Road Forum Is All About Deals, Deals, Deals

One of the reasons so many leaders from around the world are in Beijing is because the Belt and Road Forum is expected to be an important space for new deals. Some leaders are traveling with large corporate entourages in the hope of finalizing trade and investment agreements.

Going forward, this will become an even bigger part of BRI outreach as Chinese policy banks pull back on some of the big-ticket infrastructure loans that characterized the first ten years of the initiative.

Many of the deals announced this week were concluded earlier, but their signing ceremonies were held back until now for maximum impact. Here is a rundown of some of the deals signed and pursued so far.

🇪🇹 ETHIOPIA: Shirshir Addis Business Group signed a $1 billion deal with China Sinoma International Engineering for three manufacturing projects: a cement factory, a food processing facility and a car assembly plant. (X)

🇪🇬 EGYPT: The Suez Canal Economic Zone signed about $100 million worth of deals with Chinese textile and garment companies. This includes a $70 million deal for a textile manufacturing plant with Zhejiang Hengsheng Dyeing Company. Many of these deals plan exports to Europe. (ZAWYA)

🇹🇭 THAILAND: Thai Prime Minister Srettha Thavisin is traveling with a large business entourage and hopes to seal deals for high-speed rail and green energy projects. Thailand’s Board of Investors will also host an investment forum on the sidelines in Beijing. (NIKKEI ASIA)

🇨🇱 CHILE: Chile’s President Gabriel Boric said on Monday that China’s Tsingshan Holding Group will invest $233.2 million in Chile’s lithium sector. The project aims to produce 120,000 tons of lithium iron phosphate per year to be used in electric vehicles. (REUTERS)

Kenyan President’s Economic Diplomacy Agenda Will be Tested in Beijing This Week

Among the dozens of leaders attending this week's Belt and Road Forum in Beijing, few are under as much pressure to deliver tangible results from the event as Kenyan President William Ruto.

Back home, the Kenyan economy is in serious trouble amid rising unemployment, surging national debt and a currency that sunk to a new record low against the dollar this week.

So, it's not surprising then that the President is devoting most of his energy during his three-day visit to China to promote his economic agenda in the hope of securing more Chinese investment and development finance.

Ruto hit the ground running on Monday, crisscrossing the Chinese capital to meet with senior corporate and Communist Party officials:

- BUSINESS DEVELOPMENT: Ruto met with Li Xi, one of the Communist Party's most senior and powerful officials, to signal that Kenya is fully aligned with China's overseas economic development agenda. (XINHUA)

- ENERGY INFRASTRUCTURE: The President oversaw the signing of an MOU with the China Energy International Group to upgrade Kenya's electric power system. Details of the agreement were not released. (THE STAR)

- TELECOMMUNICATIONS INFRASTRUCTURE: Ruto also oversaw the signing of a second MOU, this time with telecommunications giant Huawei, to bolster Kenya's national digital infrastructure with new services in health, transportation, education and e-government. (THE STAR)

The real test, however, is going to come on Tuesday and Wednesday when Ruto meets with President Xi Jinping and later sits down with officials at China's largest policy banks to discuss a new billion-dollar loan for road construction and the need to restructure the estimated $6 billion of debt Kenya still owes these banks.

Both are very big requests in the current environment.

The days when Chinese policy banks granted billion-dollar loans to African countries are over. Chinese lenders issued less than a billion dollars of loans to the entire African continent in 2022, according to new data from Boston University's Global Development Policy Center -- making it highly unlikely the policy banks will reverse that trend for Kenya.

As for the debt, so far, the China Exim Bank, which owns most of the debt in question, has been surprisingly inflexible with Kenya by refusing repeated requests to defer repayment. Given the economic difficulties Kenya is now facing, China Exim may be more accommodating, but there's certainly no guarantee.

WHY IS THIS IMPORTANT? Ruto's push for more financing and investment from China will serve as an important bellwether to determine the effectiveness of his economic development agenda and how much Chinese stakeholders are willing to commit to Kenya and Africa more broadly.

SUGGESTED READING:

- The Standard: Why Taiwan is a diplomatic hot potato for China and will likely appear during Ruto's, Xi talks by Mwangi Maina

- Nation: On China trip, Ruto to test his economic diplomacy by Aggrey Mutambo and James Anyanzwa

Indonesia Targets Rail, Renewable Cooperation At Forum

Introducing CGSP Intelligence

CGSP Intelligence gives you the information advantage on Chinese activities in the Global South. CGSP Intelligence is launching in Summer 2025, with analysis and a full set of data tools designed for corporate and enterprise leaders.