Live Feed

The News Feed is curated by CGSP’s editors in Asia and Africa.

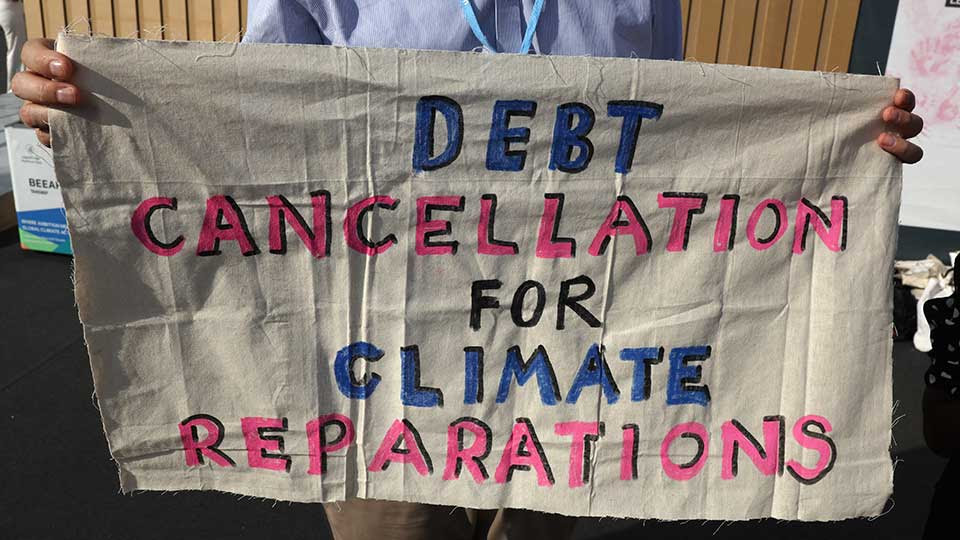

The G77 bloc of countries together with China is reportedly going to propose a new “loss and damage” fund at the COP27 summit to provide finance to poor countries impacted by climate disasters. The fund ...

China-Mexico Love-In at the G20

Even as the G20 summit focused on Chinese President Xi Jinping’s high-profile meetings, Foreign Minister Wang Yi met with his Mexican counterpart Marcelo Ebrard. While the full agenda of their meeting wasn’t ...

As COP27 Races to an Agreement, Things are Getting Real Awkward

The COP27 climate summit in Sharm el-Sheikh, Egypt, will soon head into its final stage when delegates will wrestle through the night to finalize the wording of the agreement. The summit saw the emergence of ...

EU Border Tax Proposal Sparks BASIC Backlash

An EU proposal at COP27 to tax carbon-intensive products like cement and steel is drawing resistance from a group of developing countries. At a ministerial meeting of the BASIC (Brazil, South Africa, India ...

China’s COVID Response Boosts Foreign Aid

China’s donations of physical aid jumped by 40% last year to $1.3 billion. The bulk of these donations were in response to the COVID pandemic, including vaccines and food.

Seminar Highlights China-Africa Media Alignment

Chinese and African media professionals committed to working together to reshape media narratives about Africa-China relations. Delegates from the continent gathered in Nairobi for a seminar organized by the state-owned China Media Group. ...

Xi’s State-Centric Focus an Opportunity for Africa: Analyst

The South African analyst Steven Kuo wrote in a recent column in the financial daily Business Day that Chinese President Xi Jinping’s third term heralds a shift towards state-owned enterprises: “That means there ...

Ladies and Gentlemen, Xi Jinping is Back in the Diplomatic Game

After three years of avoiding major in-person diplomatic engagements, Chinese President Xi Jinping re-emerged on the diplomatic stage with a flurry of at least eight bilateral meetings on the sidelines of the G20 ...

It May Not Look Like Much, But This Handshake Between Xi and Modi is a Big Deal

They looked at each other, smiled, shook hands for an uncomfortably long time, and even exchanged a few pleasantries. It may not look like much, but this brief interaction between Chinese President Xi ...

Why Détente Between China and Australia Could Be a Problem for Some Developing Countries

Anthony Albanese is the first Australian Prime Minister in six years to meet with Chinese President Xi Jinping and from the looks of their brief meeting on the sidelines of the ...

Even in a Foreign Country, China Made Other Leaders Treat Xi as the Host

One observation that emerged from Tuesday’s flurry of meetings between Chinese President Xi Jinping and various world leaders on the sidelines of the G20 summit in Bali was that President Xi stood at ...

U.S.-led Coalition Rolls Out First Major Infrastructure Project Under the New Partnership for Global Infrastructure and Investment

The G7 group of wealthy countries unveiled the first major initiative as part of its Partnership for Global Infrastructure and Investment (PGII), which is ostensibly aimed at countering China’s dominance in financing infrastructure ...

Biden Expressed Concern to Cambodia PM Hun Sen About What China’s Doing at the Ream Navy Base

U.S. President Joe Biden on Saturday raised concerns with the leader of Cambodia about Chinese activities at its Ream Naval Base, stressing the importance of full transparency, the White House said. But Chinese state ...

Chinese PM Li Heads Home From Cambodia After Another Round of Diplomatic Speed Dating

Chinese Prime Minister Li Keqiang wrapped up a six-day visit to Cambodia on Sunday at the conclusion of a pair of regional summits where he also held a number of sideline bilaterals with ...

Why Xi and Modi Should (and Shouldn’t) Meet on the Sidelines of the G20 Summit in Bali

While much of the attention this week at the G20 summit in Bali will be on Monday’s meeting between the U.S. and Chinese presidents, in South Asia, many observers will be keeping a ...

Why This European Man Is so Happy to Be in Vietnam

German Chancellor Olaf Scholz seemed visibly happy to be back in Southeast Asia over the weekend and specifically to be out of China. Chancellor Scholz arrived in Hanoi on Sunday to kick off a four-day visit ...

WEEK IN REVIEW: Chinese President Xi Jinping and U.S. President Joe Biden to Attend Next Week’s G20 Summit in Bali

Indonesian President Joko Widodo confirmed that both Chinese President Xi Jinping and U.S. President Joe Biden will attend next week’s G20 summit in Bali but said it’s still not certain if Russian leader ...

The China-Shaped Hole in Natural Gas Financing

The role of natural gas in African green transitions has become a flashpoint as Europe tries to maximize its own access to African natural gas while also discouraging African countries from factoring it ...

China-Linked Group Will Run Angolan Transport Corridor

The Angolan government has signed a $450 million agreement with the Portuguese infrastructure group Mota-Engil to run rail and logistics in the Lobito Transport Corridor, which connects Lobito Port to the ...

Kenya’s Supreme Court to Weigh In on SGR Contract

Kenya’s Supreme Court will rule on the legality of the country’s Standard Gauge Railway contract. Opponents say the contract being awarded to China Road and Bridge Corp contravened Kenya’s competitive ...

China Cuts Import Tariffs for Ten Poor Countries

China will cut tariffs on 98% of taxable imports from ten low-income countries. 8,786 different products from Afghanistan, Benin, Burkina Faso, Guinea-Bissau, Lesotho, Malawi, Sao Tome and Principe, Tanzania, Uganda, and Zambia will ...

China’s Growing Influence in West Africa

As former colonial powers like France and the United Kingdom lose their relevance in West Africa, the region is pivoting to China. This trend comes as China’s own confidence in ...

Chinese Oil Buying in Africa Plunges Amid Shift to Suppliers in Russia, Persian Gulf

Chinese oil imports from African countries dropped 22.6% year-on-year in the January-September period, highlighting a decade-long transition away from the continent to suppliers in Russia, the Persian Gulf and Brazil. ...

Algeria is the Latest Developing Country to Get in Line to Join the BRICS Group

The Algerian Ministry of Foreign Affairs officially submitted its application this week to become a new member of the BRICS club. Algeria now joins a growing list of developing countries, ...

Chinese Foreign Ministry Spokesman Said He’s “Not Aware” of Reports Xi Will Travel to Saudi Arabia Next Month

Chinese Foreign Ministry Spokesman Zhao Lijian tried to tamp down mounting speculation that President Xi Jinping will travel to Saudi Arabia next month to attend a pair of summits. Zhao ...

Chinese State Media Tries to Put a Positive Spin on Trade Ties With Tanzania

The Communist Party-run tabloid Global Times is trying its very best to send a positive message about the state of China’s trade with Tanzania. On Tuesday, the newspaper featured an ...

Just as in Nigeria, Kenyan Lawmakers Are Also Confused About What It Means to Waive “Sovereign Immunity” in Chinese Loan Contracts

Anger is mounting across Kenyan society over the terms of the loan agreements with the China Exim Bank for the multi-billion dollar Standard Gauge Railway that were released by the government on Sunday. ...

New Undersea Cable Will Link China to a Trio of Countries in Southeast Asia

Six telecom carriers from four countries in Asia signed an agreement to build a new regional undersea high bandwidth cable. The $300 million Asia Link Cable system will stretch 6,000 kilometers from southern ...

Kenyans React to Publication of SGR Documents

The decision by the incoming government of Kenya to release some documents relating to the controversial Chinese-built Standard Gauge Railway is causing massive controversy at home. The main reaction has been anger that ...

People’s Bank of China Exec Blames Debtor Countries for Transparency Issues

As controversy swirls over the role of Chinese lenders in successive Global South debt crises, China is still getting used to its new role as a global financier. This was one of the ...

Introducing CGSP Intelligence

CGSP Intelligence gives you the information advantage on Chinese activities in the Global South. CGSP Intelligence is launching in Summer 2025, with analysis and a full set of data tools designed for corporate and enterprise leaders.