Live Feed

The News Feed is curated by CGSP’s editors in Asia and Africa.

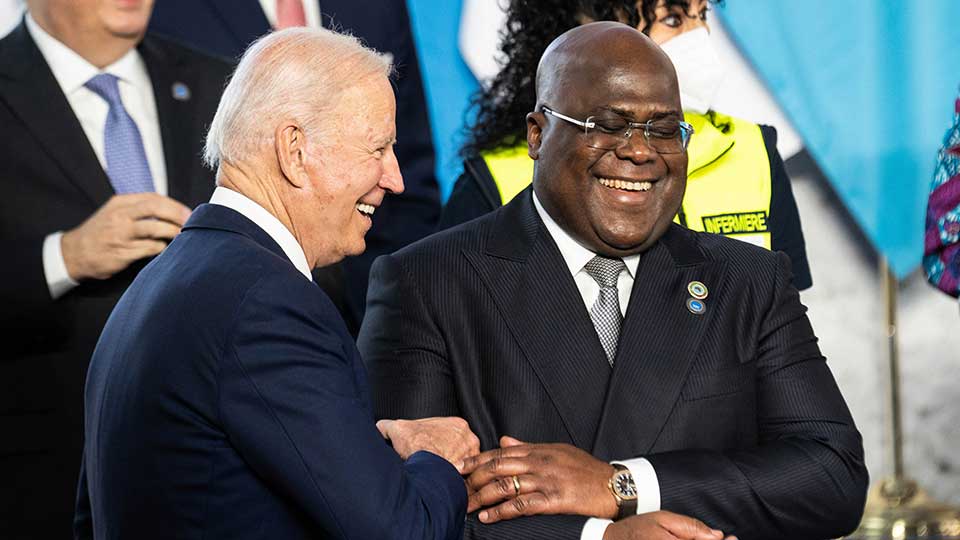

Biden-Tshisekedi Meet on Sidelines of G20

Why Some of the Most Interesting Discussions Surrounding FOCAC Won’t be in the Conference Hall

Rare Bike Collectors Take Note… South Sudan’s Got a Lot of Classics on the Streets

Week in Review: Sanctions, Supply Chains & Security

Three robbery-hijackings in a week have put South Africa's Chinese community on edge. The latest incident occurred last week in the Humewood area of Port Elizabeth where like the previous two incidents an ethnic Chinese driver was forced off the road and robbed at gunpoint. The assailants also forced the victims to use their mobile phones to transfer funds to make an online transfer to their accounts. South African police are now warning people in the Chinese community to avoid carrying large sums of cash and even to reduce the amounts of money available in standard banks accounts. (SOUTH AFRICA DAILY -- in Chinese)

Chinese President Xi Jinping is beginning to rally leaders from other developing countries to join his new "Global Development Initiative" (GDI) which he announced in his UN General Assembly speech last month. President Xi raised the issue on Wednesday in separate phone calls with Equatorial Guinean President Teodoro Obiang Nguema Mbasogo and Papua New Guinea Prime Minister James Marape. The GDI is a new 8-point policy framework that will guide China's engagement with developing countries. (XINHUA)

The President of the Asian Infrastructure Investment Bank (AIIB), Jin Liqun, said the bank will follow China's lead and discontinue financing coal projects as of next year. Currently, the bank has approved funding for 29 energy projects around the world, none involving coal, said Jin, who's in the UAE this week for the AIIB's annual meeting. By 2030, he added, the bank plans to approve $50 billion for climate-related projects. (GLOBAL TIMES)

The current congestion in the global supply chain is finally starting to benefit shippers in East Africa who are now starting to see lower prices for both vessels and containers. With so much congestion in both U.S. and European ports, traders are now re-directing vessels/containers to go from China to ports in Kenya and elsewhere in East Africa. The cost of shipping a container has dropped 29% over the past two weeks, according to the Shippers Council of Eastern Africa. (THE STAR)

Botswana joins a growing list of African countries exporting iron ore to China. The country's first iron ore mine, Ikongwe, delivered its inaugural shipment to China last month, according to company officials. This marks an important milestone for Botswana as it moves to diversify its exports beyond diamonds. It's also significant for China in light of Beijing's desire to lessen its dependence on Australian iron ore. (REUTERS)

China's ambassador to Nigeria, Cui Jianchun refuted speculation on Tuesday that a three-year-old $2.5 billion currency swap agreement between the two countries would be terminated due to a lack of interest. Instead, Cui said "the framework would be expanded" by both the Chinese and Nigerian central banks. There've been a number of reports in the Nigerian media over the past month that declared the swap agreement a failure due to bureaucracy on the Nigerian side and resistance from Chinese traders who preferred to settle transactions in USD. (THIS DAY)

Bahrain will become the second GCC country after the UAE to approve the use of the Chinese-made Sinopharm COVID vaccine on children as young as three years old. The Ministry of Health issued the new guidelines on Tuesday that also included approval of the use of Pfizer-BioNTech's vaccine on kids aged 5-11. With an average of just 65 infections a day, the COVID situation in the Kingdom is largely under control. (AL-MONITOR)

China echoed calls from the Southern Africa Development Community (SADC) for all international sanctions against Zimbabwe to be removed. Beijing and the SADC both issued their appeals to coincide with the third "Anti-Sanctions Day." Chinese Foreign Ministry spokesman also singled out the U.S. for what he described as "illegal sanctions" against Zimbabwe. (@SADC_NEWS)

The Nigerian government is demanding that Sinohydro and other Chinese contractors working on the $1.3 billion Zungeru hydroelectric plant finish on time at the end of the year. Minister of Power Abubakar Aliyu called representatives of the construction companies to his office late last week to make sure they were clear about the need to complete the project on time. When complete, the 700-megawatt power plant will generate an estimated 10% of Nigeria's electricity. (LEADERSHIP)

DR Congo President Félix Tshisekedi appointed veteran diplomat François Nkuna Balumuene as Kinshasa's next ambassador to China. Previously, Balumuene served as ambassador to both the United States and India. He's been in the Congolese foreign service for more than 30 years. Along with Balumuene, President Tshisekedi announced five other ambassadorial appointments: to France, Ivory Coast, UAE, Belgium, and the United Nations. (MEDIA CONGO)

The Secretariat of the Africa Continental Free Trade Area (AfCFTA) and the Chinese Ministry of Commerce announced plans to create a working group to discuss economic development and integration between the two sides. The two sides, according to the MoU, will discuss intellectual property rights, customs policies, and digital trade among other areas. This new working group is an evolution of the ideas that have been coming from Chinese think tanks over the past two years about integrating AfCFTA with the Belt and Road. (GHANA NEWS AGENCY)

The $2.5 billion/15 billion RMB currency swap deal between China and Nigeria has not lived up to expectations as most Nigerian traders avoided using RMB to settle transactions and stuck with USD. The 2018 deal was supposed to make it easier for both Chinese and Nigerian traders to interact with one another but bureaucracy and conversion bottlenecks slowed the utilization by Nigerians, while Chinese businesses preferred to deal in dollars. (LEADERSHIP)

The Worst May Be Over For Embattled Chinese Mining Giant Sicomines

The Sino-Congolese mining company Sicomines, which has been under intense scrutiny for the past several months over its 2007 contract with the government, is now communicating with a sense of confidence that gives the impression its troubles with the authorities in Kinshasa may be over.

This is partially attributable to an aggressive PR campaign by Chinese mining companies in the DRC that by most measures has been very effective in shifting the narrative. Kinshasa's rival political camps are also now focusing more attention on the launch of next year's presidential campaign and it's clear that few people see much benefit in prolonging tensions with some of the country's largest foreign investors.

Of course, nothing is ever certain in the DR Congo, but at least for now, Sicomines' fortunes seem to have improved considerably.

CARI Researchers Critique AidData’s Report on Chinese “Hidden Debt” in BRI Countries

With New Chinese Money Hard to Come By, Kenya’s Treasury Turns to the Bond Market to Finance Infrastructure

The Kenyan government is making preparations to float its largest-ever bond offering, a record $1.3 billion (Sh150 billion) issuance. It will be used to settle debts with contractors, possibly including some Chinese companies, and to fund road projects that are currently in development.

Infrastructure Principal Secretary Paul Mainga told parliament on Tuesday that the Treasury, the Central Bank of Kenya (CBK), and the Attorney-General all approved the sale.

Mainga added that the bonds will be priced at market rates but they still haven't finalized the repayment term.

The Kenyan bond offering is the latest example of the evolution of infrastructure finance in Africa, as financing from both bilateral and multilateral creditors has shriveled from $100 billion in 2014 to $55 billion in 2019 to just $31 billion last year, according to data from the international law firm Baker McKenzie.

But there's reason for optimism though, according to Lodewyk Meyer, a partner in Baker McKenzie's South Africa office, who says a new crop of international financing agencies from the U.S., Europe, and even China are now more interested in providing capital to build infrastructure in Africa. "The way in which infrastructure financing deals are structured in Africa has clearly become more inventive, and I am encouraged that alternative sources of funding are raising activity in the region," he said.

Key Highlights From Lodewyk Meyer's Report on the Evolution of Infrastructure Finance in Africa

- MORE PLAYERS: "Local and regional banks [in Africa], specialist infrastructure funds and private equity and debt are also stepping in to collaborate with DFIs and access returns, and multi-finance and blended solutions are expected to grow in popularity as a way to de-risk deals and support a broader ecosystem of lenders."

- THE IMPORTANCE OF DEVELOPMENT FINANCE INSTITUTIONS: "There is a deepening DFI involvement in the infrastructure ecosystem at large, with DFIs increasingly anchoring the infrastructure ecosystem in Africa — serving a critical function for project finance as investment facilitator and a check on capital. This is because they can shoulder political risk, access government protections and enter markets others can’t, as well as being uniquely capable of facilitating long-term lending."

SUGGESTED READING:

- Lexology: Africa: The evolution of infrastructure finance by Lodewyk Meyer

- Business Daily: State eyes record Sh150bn bond sale to clear debt, fund roads by Edwin Mutai

Chinese State Media: Blame the U.S. For the Coup in Sudan

Although the Chinese Foreign Ministry has been largely silent this week about the military coup in Sudan, the country's largest television broadcaster, CCTV (央视新闻), appears to be framing the story in a way that lays the blame for the collapse of the civilian government squarely at the feet of the United States.

Given that this is CCTV, by far the country's most influential media outlet, it's quite likely that the evolving narrative on Sudan that they're disseminating closely aligns with official thinking in the Foreign Ministry.

In a story published on Wednesday by CCTV's news wire, the network framed their story around an interview with a Khartoum-based "political analyst" [no clear affiliation available] by the name of Khalid al-Faki who, incidentally, is also a source for the U.S. government-funded network VOA. Chinese propaganda often uses foreigners to criticize Beijing's rivals, particularly the United States. It gives the government plausible deniability to effectively say it's not us criticizing you, but international "experts."

In the CCTV analysis of who is to blame for the toppling of the government, al-Faki, unsurprisingly, made no mention of China's extensive role in Sudan over the past two decades, but went into great detail about why he thinks the U.S. is largely responsible:

- U.S. SANCTIONS: "Many children died due to a lack of medicine and medical equipment. This was caused by the sanctions and hegemonic actions of the United States. If it were not for U.S. sanctions, Sudan’s economy would not have been so bad. Sudan is a country with relatively rich oil, mineral, agricultural and industrial resources. Sanctions and hegemonic policies severely damaged Sudan’s economic development and prevented the country from functioning normally."

- U.S. INTERFERENCE: "Just before the turmoil on October 25, U.S. Special Envoy for the Horn of Africa, Jeffrey Feltman, visited Sudan and met with Sudanese military and civilian leaders. The U.S. Bureau of African Affairs blatantly threatened on social media that any 'change of the transitional government by force' would 'endanger U.S. aid to Sudan.' Western countries, led by the United States, violently interfered in Sudan's internal affairs under the pretext of 'freedom and democracy' and 'economic assistance.'"

The article grimly concluded that, given the extent of U.S. "interference" in Sudan, it wouldn't have mattered who was in charge or what kind of government was in power, the result would have been the same.

Read the full story in Chinese on the China News (中新网) website -- in Chinese.

Two Chinese Experts Call for Beijing to Do More to Provide Non-Vaccine Assistance to Combat COVID in Africa

Simply shipping more jabs to Africa will not be enough to fulfill Chinese President Xi Jinping's commitment to make COVID vaccines a "global public good," argued two experts in a column published this week on the site "China and International Development."

Instead, Lu Xin, an advisor to the National Development Research Institute at Peking University and Shen Dichai, CEO of Boruizhi Consulting, contend that it's equally important to focus on so-called "non-vaccine support" that includes the logistics and infrastructure needed to get the vaccines to the right places.

The two also argue that better training of medical personnel is equally important to boost vaccination rates on the continent.

How China's Non-Vaccine Support Can Help African Countries in the Battle Against COVID:

- COLD CHAIN: Last November's announcement that Alibaba's Cainiao logistics unit together with Ethiopian Airlines teamed up to form a cold chain air bridge is a good start but land-based cold chain infrastructure is equally important, especially in sub-Saharan Africa where there is a further challenge brought on unstable power supplies in many countries. Chinese companies already have some experience in this realm, for example the Chinese company Aucma's (澳柯玛公司) development of a -60C vaccine storage container for Ebola vaccines that could be applied to COVID vaccines as well.

- PUBLIC HEALTH INFRASTRUCTURE: China has focused a lot of effort in recent years to build primary medical facilities and invested in public health infrastructure which is also critical to facilitating the training of medical personnel on the continent. More, clearly, needs to be done in this area.

Read the full column on the China and International Development website (in Chinese)

In Phone Call With Macron, Xi Pursues Trilateral Development Cooperation in Africa

Chinese President Xi Jinping urged his French counterpart Emmanuel Macron in a phone call on Tuesday that the European Union should pursue greater autonomy (presumably from the U.S.) in its foreign policy.

The two leaders also discussed the upcoming COP26 climate summit in Scotland and even though President Xi will not attend in person, President Macron nonetheless asked the Chinese president to convey "a decisive signal" that Beijing is committed to reducing its emissions.

Africa did come up in the conversation but you wouldn't know it from reading the Elyseé Palace readout of the call or any of the international media coverage. But Xinhua prominently featured the issue in its coverage of the discussion (the third paragraph out of a 17 paragraph story):

"China, [President Xi said] is ready to work with France to continue cooperation on biodiversity conservation, deepen green cooperation, implement the Global Development Initiative, and carry out tripartite cooperation in Africa and other regions."

This is the second time this year that President Xi has raised the issue of development cooperation with France in the Global South, notably in Africa. He also floated the idea during a virtual summit in July with former German Chancellor Angela Merkel and President Macron when he called on the two to join the Initiative on Partnership for Africa's Development, a framework Beijing launched with African countries in May.

Although there doesn't seem to be a lot of enthusiasm on the part of either France or Germany to reciprocate China's offer to collaborate on African development initiatives, it's likely that President Xi will persist with the issue as part of a broader effort to push back against the U.S.-led G7 Build Back Better World (B3W) that is presented as a rival to his signature Belt and Road Initiative (BRI).

But given souring views on China in both Germany and France, a trio of researchers at Johns Hopkins University, including Professor Deborah Brautigam from the China-Africa Research Initiative, argue in a recently published column in the East Asia Forum that there's little chance that either European country will want to join China's "Africa Quad."

Why China's Africa Quad is "Doomed to Fail"

- SOCIAL AND ENVIRONMENTAL CHALLENGES: "German officials hesitate to lend their name to projects they perceive as non-compliant with their own environmental and social standards. The critical parliamentary inquiry into the German state-owned KfW Development Bank’s involvement with Chinese contractors in Africa is a case in point." (READ MORE)

- LACK OF INTEREST FROM THE BUSINESS COMMUNITY: "Sino–French and Sino–German business and banking connections in Africa have failed to produce a consensus in favor of cooperation. Yet the first proposal for a European, Chinese, and African trilateral partnership was co-authored by France and Germany in 2008." (READ MORE)

SUGGESTED READING:

- Xinhua: Xi talks with Macron over phone

- East Asia Forum: Why France and Germany won’t join China’s ‘Africa Quad’ by Lucas Engel, Reed Piercey, and Deborah Brautigam

Jake Sullivan: B3W Will Show How Americans Can Outcompete China on Infrastructure

U.S. National Security Advisor Jake Sullivan (photo) reiterated what's has become a common talking point in Washington: that the administration's Build Back Better World (B3W) initiative is going to challenge China's Belt and Road Initiative head-on.

Sullivan spoke to the media on Tuesday in the White House Briefing Room to talk about the President's upcoming European trip to attend the COP 26 climate conference in Scotland and the G20 summit in Rome. On several occasions during his remarks, Sullivan returned to B3W and said clearly that he's confident that when it eventually launches (still TBD by the way), this new initiative will outcompete the BRI in "every aspect":

"In advancing the Build Back Better World initiative — the B3W initiative — he will show how a high-standards, climate-friendly alternative to the Belt and Road Initiative can help American firms and American workers compete globally on every aspect of infrastructure, from physical to digital to health."

It's worth noting, however, that other than a three-nation Latin America "listening tour" in September there's been no visible progress by the White House in making B3W a reality, much less a credible challenger to the BRI.

More listening tours are apparently in the works and administration officials say they plan to unveil more details about the initiative at a conference early next year.

SUGGESTED READING AND VIEWING:

If the U.S. is Going to Compete Against China’s BRI, Then It’s Going to Have to Mobilize the Private Sector… And That Won’t Be Easy

If the proposed B3W has any chance of rivaling China's eight-year-old Belt and Road Initiative, the U.S. government is going to have to persuade development finance institutions, private companies, and Wall Street that building infrastructure in some of the world's highest risk countries is a good investment.

Access to huge pools of private capital will be the defining difference between the U.S. approach and China's state-led initiative that, until now, has largely relied on the country's two main policy banks, the China Exim Bank and the China Development Bank to fund hundreds of billions worth of infrastructure development throughout the Global South.

But if recent history is any guide, it's going to be a very hard sell. "From 2015 to 2019, the private sector in the Group of Seven (G7) countries invested a mere $22 billion in infrastructure projects in developing countries," according to Jennifer Hillman and Alex Tippett, both scholars at the Council on Foreign Relations in New York.

Nonetheless, Hillman and Tippett remain optimistic so long as the White House takes some key steps to "increase the appeal of infrastructure investments" for private sector actors:

- CREATE AN INFRASTRUCTURE INVESTMENT BUNDLE: "Mold infrastructure projects into a standardized and tradeable asset class, so investors do not have to analyze the intricacies of individual projects. This approach has been endorsed by several multilateral institutions, including the Group of Twenty (G20) and the OECD[...]

"There is a sense that institutional investors, who are less averse to the long time-horizons associated with infrastructure projects and manage vast quantities of capital, would be more willing to direct funds towards infrastructure projects if they were housed in a standardized and well-documented asset class."

- CREATE A SET OF UNIVERSAL STANDARDS FOR PROJECTS: "Standardization in this instance implies a greater degree of coherence and transparency in the legal, financial, and technical factors associated with projects. Financing structures and fine-grained issues like termination rights and dispute resolution mechanisms can make projects more or less attractive to private investors.

"For large investors who can move significant sums, however, the need to conduct a thorough examination of small individual projects can make infrastructure unappealing."

Read the full blog post on the Council on Foreign Relations website.

Nairobi Commuters Will Finally Get Some Relief When First Section of New Chinese-Financed Expressway Opens This Weekend

China, DRC Sign Three Agreements to Reduce Debt and Provide New Aid

Chinese ambassador to the DRC Zhu Jing and Foreign Affairs Minister Christophe Lutundula Apala posed for a ceremonial fist-bump at the Foreign Ministry in Kinshasa following the signing earlier this month of three new accords that will provide additional Chinese aid to the DRC while eliminating some of its zero-interest debt.

The various accords include a $15 million (100 million RMB) unrestricted grant and the cancellation of a $29 million zero-interest loan. The Chinese government also provided President Félix Tshisekedi's office with a $2 million grant to help cover the expenses related to Kinshasa's tenure as president of the African Union.

And just for good measure, Ambassador Zhu also threw in a Huawei IdeaHub Pro65 digital whiteboard to the Foreign Ministry.

Read more on the story on the Media Congo website (in French)

Chinese Embassy in Sudan Activates Emergency Protocols, Orders Companies to Stop Work and Personnel to Take Shelter

Chinese FM Meets With Afghan Interim Government Delegation During Qatar Visit

Should Chinese Nationals Help Supervise Mining Activities in the DRC? A Military Governor Thinks So, But Kinshasa Says Otherwise

The Vice Minister of Mines in the DR Congo, Godard Motemona, declared that the appointment of three Chinese nationals to help supervise Chinese mining activities in the far eastern province of Ituri is "null and void."

The controversy began last Thursday when the military governor of Ituri, Lieutenant-General Johnny Luboya N'kashama, named three Chinese nationals with connections to the local mining industry to serve as emissaries of sorts between the provincial government and the many Chinese mining companies operating in the region.

The general, according to the letter, hoped that these Chinese envoys would "initiate a monitoring and evaluation mission of the mining sector" in a bid to identify mining companies that were operating illegally or violating environmental and labor regulations.

Not surprisingly, the appointment of foreigners to this position sparked widespread outrage across the country, even as far away as the capital Kinshasa. This controversy was sharpened by the fact that they're Chinese nationals, given the difficulties that Chinese entities have encountered in the DRC over the past year.

The Deputy Minister said N'kashama violated the law with his letter and then ordered the three Chinese named in the letter to come to Kinshasa for a meeting that is scheduled to take place this Thursday.

SUGGESTED READING:

- Congo Profond: Appointment of the Chinese in the mining sector in Ituri: Deputy Minister of Mines Godard Motemona scolds the military governor and summons the appointed Chinese! (in French)

- Politico.cd: Chinese mining operators in Ituri: Johnny Luboya pleads for a monitoring and assessment mission (in French)

Nigeria Unveils a Chinese-Style Digital Currency Platform

Nigeria's President, Muhammadu Buhari, unveiled the country's new digital currency platform, eNaira, on Monday. It is Africa's first virtual currency.

The new service will allow Nigerians to make contactless payments, move money between accounts and manage their accounts virtually. Unlike other digital currencies, however, the eNaira isn't an unregulated cryptocurrency. Instead, it will be pegged to the naira itself, which means its value will also fluctuate against the U.S. dollar.

The Nigerian Central Bank also followed China's digital currency governance model by requiring users to download an app created by the government that is also subject to regulation and control. This means that, just as in China, the use of the official digital currency in Nigeria will not be anonymous.

China Commemorates 50 Years at the UN With a Hat Tip To Africa

China celebrated the 50th anniversary of its return to the United Nations on Monday, marking the day in 1971, when Beijing took over the seat from the Republic of China government in Taipei.

That achievement is also a milestone in Beijing's relations with African countries who provided 26 of the 76 votes needed to pass the resolution.

How Will China Respond to the Coup in Sudan?

The pre-dawn military coup in Sudan on Monday presents the latest challenge for China on how to respond to the toppling of governments in Africa where it has sizable economic and strategic interests.

Normally, the Chinese Foreign Ministry tends to be very reluctant to comment on coups, as was the case in Myanmar in February when Beijing did its best to take a low profile, but not so in Guinea when China condemned the September overthrow of President Alpha Condé's government within the first 24 hours.

Although Guinea's vast iron ore reserves are vitally important to China, Beijing's interests (and investments) in Sudan are much more complex. Chinese oil major CNPC has billions invested in the country, dating back decades, state-run shipping giant COSCO has been in talks to revamp Sudan's shipping fleet and there's a great power rivalry dynamic to the relationship, given the efforts made by both France and the United States to build stronger ties with Khartoum.

Given the fluidity of the situation in Khartoum and China's large portfolio of interests in the country, it's likely that Beijing will probably wait to respond, similar to how it reacted to developments in Myanmar, rather than issuing a quick denunciation as it did immediately after the government was toppled in Guinea.

The first clue will come on Monday at the Foreign Ministry's press briefing in Beijing, where we'll see whether a Chinese media outlet will present a choreographed question on the issue to the spokesperson.

One Kenyan Entrepreneur’s Cautionary Tale About Replacing Chinese Imports With a Locally-made Alternative

Kenya's gaping trade imbalance with China is typical of many African countries that import significantly more than they export to the Chinese market. This has prompted calls going back years for Africans to reduce their dependency on Chinese imports and manufacture more at home, particularly in the new era of the AfCFTA.

But the 28-year old Kenyan entrepreneur Anthony Muthungu (photo) has recently experienced just how hard it is to do that in practice, according to a story by Capital News.

Muthungu borrowed $27,000 from a friend to launch a business manufacturing USB cables that are used to recharge phones. After carefully studying 7,000 different cables, he found a niche in the market that would allow him to build a higher quality cable at a lower cost than what comes from China.

But two years in, he's really struggling. He's getting hit by the high cost of electricity and fuel to power his factory plus resistance from consumers who seem to trust "Made in China" more than "Made in Kenya."

“I don’t know whether it’s a colonial mentality where people think anything made in Kenya is inferior. It’s like we can’t make it Kenya, this must be fake. Others want to buy it cheaply just because it’s made in Kenya,” Muthungu explained.

Uganda’s Parliament Considering New Law to Bolster Local Construction Companies Against Chinese Competition

The Ugandan parliament is considering a bill proposed by infrastructure minister Katumba Wamala that would provide sanctuary to local construction companies when bidding for smaller road contracts.

Although China was not mentioned in the proposed legislation specifically, it's widely believed that the new law is intended to shield Ugandan contractors from China's state-owned construction companies that have been very successful in building roads throughout the East African country.

Chinese and other foreign contractors are often chosen over smaller local companies because they have more financial resources and a longer track record. This has caused quite a bit of controversy in a number of countries like Namibia and Nigeria, where vibrant construction sectors exist, but whose companies often can't compete against the Chinese multinationals.

If the new law is passed, road construction projects valued at less than $12 million would be reserved for local companies.

SUGGESTED READING:

Chinese Contractors Almost Finished With Upgrade and Expansion of Uganda’s Main International Airport

Five years after the state-owned China Communications Construction Company (CCCC) began work on a $200 million upgrade and expansion of Uganda's Entebbe International Airport, project managers say the project is 75% complete.

When completed the new cargo terminal will be able to handle 100,000 tons of cargo and 3 million passengers annually.

The $200 million project is being financed using a loan from the China Exim Bank.

This is the first major upgrade of the airport since it was built by the British colonial government more than 70 years ago.

SUGGESTED READING AND VIEWING:

- Xinhua: China revitalizes Uganda's aging airport to carry more int'l traffic by Ronald Ssekandi

- Xinhua: video about CCCC's construction of the new Entebbe International Airport

Egypt and Sinovac in Talks to Boost Vaccine Production For Africa

Egyptian Health Minister Hala al-Zayed met last week with Gao Qiang, head of R&D at Chinese vaccine maker Sinovac Biotech, to discuss how the two sides can expand production at the company's factories in Egypt in order to make more jabs available for other African countries.

Sinovac vaccines are being prepared at a "fill-and-finish" facility outside of Cairo that's run by the state-run pharmaceutical manufacturer VACSERA. So far, the joint venture has produced around 16 million doses at that plant, according to Beijing-based consultancy Bridge.

Who Has Distributed More Vaccines Abroad, China or the U.S.? Well, It Depends on What You’re Counting

Together, the Chinese-made Sinopharm and Sinovac vaccines account for almost half of the 7.3 billion COVID-19 vaccines that have been delivered to date around the world, especially to developing regions in Asia and Latin America (not so much in Africa).

But the overwhelming majority of those Chinese vaccine distributions are in the form of sales, not donations, a point picked up on by the United States in its recent announcement that it had donated 200 million doses to more than 100 developing countries.

In a recent video post on Twitter, the State Department subtly took aim at China by declaring that it has donated "more than any other country... at no cost" and "with no strings attached."

Large Shipment of Chinese Vaccines Arrive in Ethiopia at a Crucial Time for Beijing’s Ties With Addis Ababa

China's ambassador to Ethiopia, Zhao Zhiyuan handed over a donation of 800,000 doses of Sinopharm COVID-19 vaccine on Sunday to Health Minister Lia Tadesse at a ceremony at the international airport in Addis Ababa.

What's notable here is that Ethiopia has been the recipient of a disproportionately large amount of donated vaccines from China (more than 1.8 million doses) compared to most other African countries that have been required to purchase the bulk of their jabs from Chinese pharmaceutical companies.

The timing is also critical as Ethiopia's ties with the United States are souring over Washington's threat to impose sanctions and strip Addis of its duty-free trade privileges under the African Growth and Opportunity Act in response to the ongoing war in the northern Tigray region.

In contrast, China has become increasingly vocal over the past several months in its defense of Ethiopia against the U.S., blasting Washington for violating Ethiopia's sovereignty and "interfering in its internal affairs."

Huawei’s Former Premium Smartphone Brand Honor Hopes to Make a Comeback in Africa

Huawei's former premium smartphone brand Honor (now owned by the Shenzhen city government) plans to make a big push in South Africa next year with the opening of three retail stores and distribution deals with the country's major telcos Vodacom, MTN, and Telkom. (TECH CENTRAL)

Other China-South Africa Business Headlines:

- WINE: Importers say that South African wine had not, until recently, been widely available and marketed in China, especially compared with wine from Australia, Chile, France and Italy. But an ongoing trade dispute between China and Australia has opened up new opportunities for South Africa’s wine producers, including smaller and boutique brands. (SOUTH CHINA MORNING POST)

- TRADE: National Assembly Speaker, Nosiviwe Mapisa-Nqakula met with Li Zhanshu, Chairperson of the Standing Committee of the National People’s Congress, on Friday to discuss bilateral trade issues and "best practice on parliamentary governance." (THE CITIZEN)

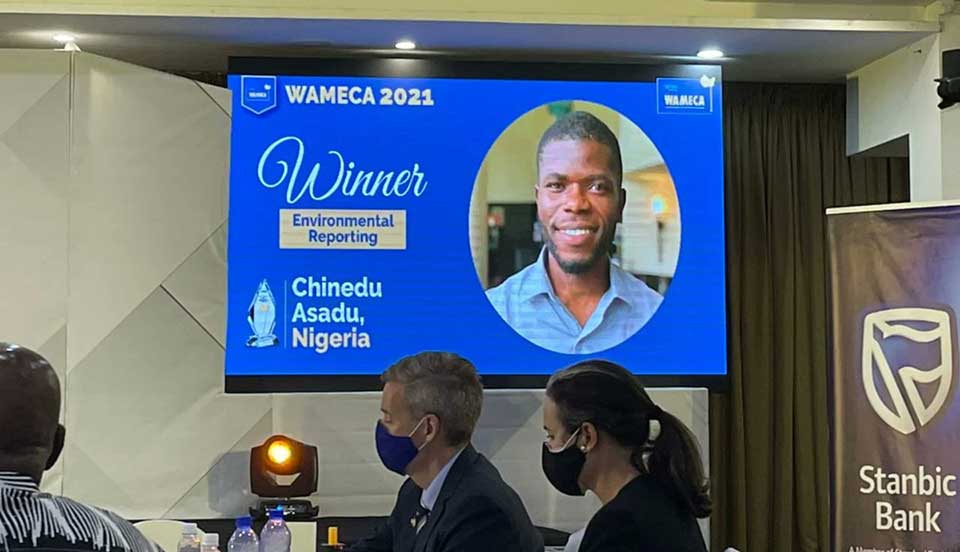

Nigerian Journalist Wins West African Reporting Prize For Coverage of Illegal Chinese Mining

We Now Know More About Zambia’s Debt… And It’s Not Good

The Zambian government owes creditors close to $27 billion, according to new data released by the Finance Ministry on Wednesday. The majority of those debts, $16.86 billion, are owed to foreign creditors and also include half a billion dollars of penalties for late payments.

Nearly 40% of those foreign debts or $6.6 billion is owed to at least 18 different Chinese creditors, according to new research published earlier this month by the China-Africa Research Initiative at Johns Hopkins University.

The remaining $10.1 billion is denominated in kwacha and owed to various domestic creditors.

For an economy with a GDP of just $19.32 billion, according to the World Bank, this is a dangerous level of debt -- with a debt-to-GDP ratio that ranges somewhere between 115% and 139% and it could be even higher given that the economy has likely contracted in 2021.

Hichilema Is Going to Have to Move Fast to Negotiate Deals With Creditors

- PRIVATE CREDITORS: Zambia has already defaulted once on its Eurobond debt and second a non-payment could lead to a devasting ratings downgrade that will trigger higher borrowing costs in the future. Zambia has a $750 million Eurobond payment due next year that it already says it won't be able to meet. The President is hoping an IMF deal will provide him the breathing room he needs with private creditors but it's a high-risk proposition, given how inflexible bondholders have been to date.

- CHINESE CREDITORS: Whereas the President has spoken in public about his plans to deal with the IMF and private creditors, he's said next to nothing about what he intends to do about the swelling levels of Chinese debt. Remember, the $6.6 billion that's on record now does not include arrears or penalties, so the figure could be much higher. The President has not signaled to the markets that he has either a plan or a point person in charge of leading talks with the consortium of Chinese creditors who, like the bondholders, have so far not shown much inclination to be flexible.

The timing of Zambia's burgeoning debt crisis couldn't be worse. It comes at the end of a multi-decade boom in China's property development market that is likely going to weigh heavily on demand for copper, Zambia's primary source of hard currency.

“A long and drawn-out transition for China’s property sector lies ahead,” Larry Brainard, chief emerging markets economist at TS Lombard told the Financial Times. “This points to a reversal in the bullish commodity price outlook that has favored some emerging markets.”

SUGGESTED READING:

- Reuters: Zambia owes nearly $27 billion in foreign and local public debt

- South China Morning Post: China in Africa: Zambia’s Chinese debts nearly double the official count, study says by Jevans Nyabiage

Introducing CGSP Intelligence

CGSP Intelligence gives you the information advantage on Chinese activities in the Global South. CGSP Intelligence is launching in Summer 2025, with analysis and a full set of data tools designed for corporate and enterprise leaders.