This is a free preview of the upcoming Critical Minerals Weekly Digest, part of the new CGSP Intelligence service launching in Summer 2025.

Introduction

This week, the critical minerals landscape was largely shaped by three major stories: the United States and Ukraine are shifting to seal a minerals deal, Russia is looking to cut rare earth reliance on China, and China CMOC is hinting at a fresh merger and acquisition in Africa as another Chinese miner was hit with unprecedented litigation in Zambia. These trends are all coming to a head in a way that is making minerals markets more contested, politicized, and litigious — and reshaping risks and rewards for banks, investors, and policymakers.

U.S.–Ukraine Mineral Investment Fund Kicks Off

Ukraine and the U.S. held the first board meeting of their joint mineral investment fund, a mechanism granting Washington preferential access to Ukrainian critical minerals in exchange for investment and peace. Kyiv sees it as an economic lifeline and part of its wartime survival strategy.

Why This Matters

This fund creates a structured channel into one of the world’s riskiest yet resource-rich frontiers. Political risk insurance and blended finance models will be key to overcoming these issues. This agreement links Ukraine’s recovery directly to American-led supply lines and may diminish Russia’s future access to Ukrainian minerals. Arguably, the intended message to China is that Washington will work with its partners to access critical inputs.

Russia Pushes Rare-Earth Plan to Cut Reliance on China

The Kremlin has ordered a national program to build rare-earth capacity by November, explicitly aimed at reducing dependence on Chinese inputs for defense and technology supply chains.

Why This Matters

Russia’s rare earth buildout could lead to new project finance requests, but Western exposure will be constrained by sanctions. Funding from Russian state banks is possible, but the project will depend on sanctions, carve-outs, and technology transfer. This represents an unusual departure from the usual Sino-Russian unity. Both powers are eyeing control over critical minerals, but in Russia’s case, its drive to decouple itself from Chinese supply chains has added a competitive dynamic to the BRICS-based relationship. For both the U.S. and the European Union, it complicates attempts to economically isolate Russia, while also restraining Chinese ascendency.

CMOC Signals More Africa M&A

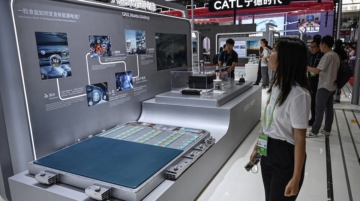

China’s CMOC, the world’s largest cobalt producer, signaled plans for fresh acquisitions in Africa and South America after overcoming export disruptions in the Democratic Republic of Congo.

Why This Matters

CMOC’s expansion would increase the value of cobalt and copper assets across Africa and Latin America. Expect more dealmaking competition and higher entry costs for non-Chinese participants. CMOC’s growth would likely increase China’s hold on cobalt, which is critical for electric vehicle batteries. This cements Beijing’s influence over global supply chains of green technology, undermining Western tactics of diversifying supply away from Chinese-controlled assets.

Zambian Communities Confront Chinese Copper Miner After Toxic Dam Collapse

Communities hit by a tailings dam burst at Sino-Metals’ copper mine in Zambia have filed a lawsuit demanding $220 million in interim compensation and $9.7 billion for a victims’ and rehabilitation fund. The case, backed by 40 civil society organizations, could become one of the most significant environmental claims against a Chinese miner in Africa.

Why This Matters

This lawsuit raises the litigation and ESG compliance risk premium for mining investments in Africa. Banks and funds will need to factor in potential liabilities when pricing deals, especially where Chinese firms dominate. It could set a precedent — communities are increasingly willing to bypass government mediation and use courts directly. To avoid litigation exposure, mining companies will need stronger community engagement, insurance coverage, and ESG audits. This case tests whether Zambia’s judiciary can enforce environmental law against a Chinese state-linked miner. A court ruling against Sino-Metals would embolden communities across Africa, potentially constraining China’s “resource-for-infrastructure” model. A quiet settlement, by contrast, would reinforce the perception that Chinese firms remain insulated from meaningful accountability.

In context

These developments capture the strategic tensions shaping the minerals sector: the U.S. is using finance to secure allies’ resources, Russia is racing to cut Chinese leverage in rare earths, China’s CMOC is doubling down on African assets, and Zambian communities are turning to courts to challenge Beijing’s mining model.

For investors, the lesson is that risk is multiplying across three axes: political volatility, regulatory enforcement, and community litigation. ESG is no longer optional; it’s becoming legally enforceable. For policymakers, the thread connecting all these stories is clear: critical minerals are now an arena where diplomacy, industrial policy, and community resistance directly intersect.