Chinese mining and battery giant Huayou Cobalt is close to completing a $400 million lithium sulphate processing plant in Zimbabwe, the first of its kind on the continent, underscoring its commitment to supporting the country’s efforts to climb the global battery supply chain.

The plant, operated by Huayou’s subsidiary, Prospect Lithium Zimbabwe, is designed to produce 50,000 metric tons of lithium sulfate annually. Lithium sulphate is made from processing lithium ore and is a key component used in EV batteries, smartphones, and energy storage systems.

Currently, Zimbabwe’s lithium mines export concentrate, a semi-processed form of lithium ore that requires further processing stages to be completed abroad, mainly in China. With global demand for lithium projected to soar, the Zimbabwean government tightened export rules as part of an effort to capture more of the value domestically, prompting miners to process ore locally.

So far, most mining companies have been reluctant to build processing plants to move up from lithium concentrate, citing chronic power shortages, water scarcity, limited infrastructure, and a shortage of skilled labor.

Huayou’s investment, however, could mark a turning point. Its new facility will convert lithium concentrate, a semi-processed product produced from the first stage of lithium processing, into lithium sulphate, which is made from the second stage of lithium processing.

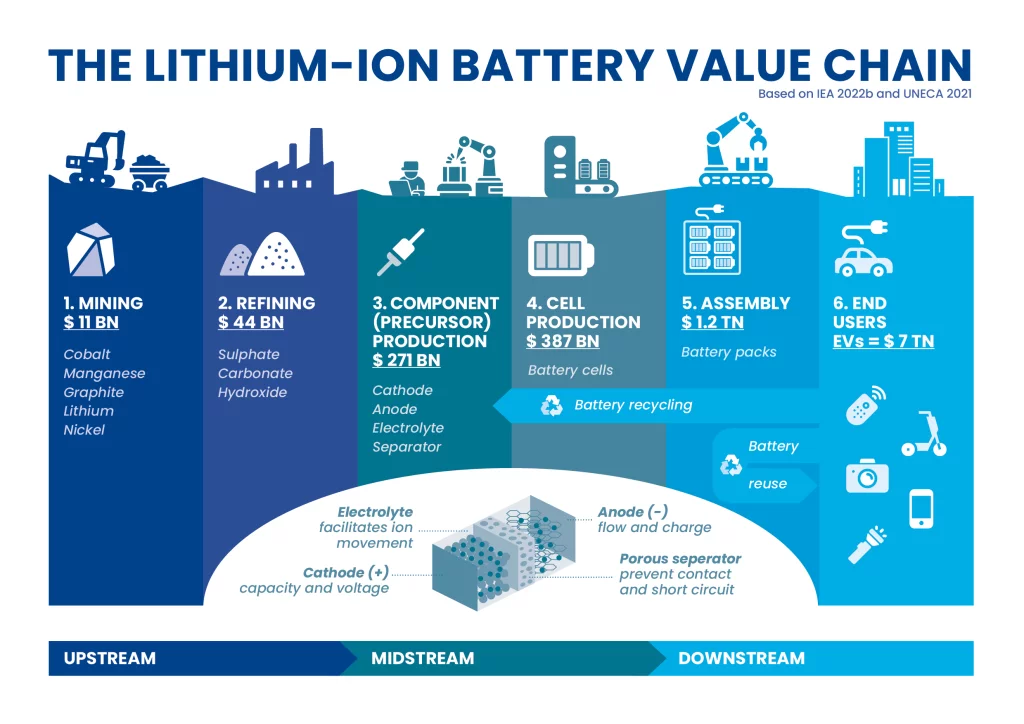

Typically, a lithium-ion battery value chain spans several stages: upstream mining and refining, midstream cell component production, and downstream assembly and end-use.

Although the production of lithium sulphate from Huayou’s plant will elevate the country one notch up within the processing chain, Zimbabwe still remains near the bottom of the production process, at the second stage of the value chain for lithium-ion batteries.

Challenges Ahead

Despite the optimism, structural weaknesses weigh on Zimbabwe’s lithium ambitions. Power shortages are the most pressing hurdle.

Some Chinese lithium mining companies in the country, such as Sichuan Yahua, which runs Kamativi Mining Company (KMC) in the northwestern part of the country, have started with constructing a 33kv on-grid power lines to secure supply from the country’s largest power station, Hwange, a coal-powered facility that produces more than half of Zimbabwe’s electricity output. Given that the 33kv is small enough to sufficiently power the company operations, and is still reliant on the national grid, KMC is still affected by the power crisis.

Similarly, Max Mind Investments, a subsidiary of China’s Chengxin Lithium Group, mining lithium in Buhera in the eastern part of the country, recently completed construction of a 15MW off-grid thermal plant to meet its energy needs. The company spent $25 million on the plant, which will use coal from Hwange.

Transport is another challenge. With Zimbabwe’s railway system in disrepair, heavy equipment is trucked from Mozambique’s Beira port at high cost. A representative from Kamativi Mining Company, whom I spoke to earlier this year, said they were struggling with logistics costs and that rail would be their preferred option if the network were functional.

The government is seeking to address the problem. Earlier this month, President Emmerson Mnangagwa met executives from China Railway Group (CRG) in Beijing to discuss a $600 million deal to overhaul Zimbabwe’s rail infrastructure. CRG is the largest railway construction company with its main shareholder being the state-owned China Railway Engineering Corporation. The agreement, expected to be signed soon, will cover the modernization and rehabilitation of existing lines, the installation of new signaling systems, and the acquisition of 17 locomotives and 209 freight wagons.

CRG, through its subsidiary TransTech Engineering Corporation – a Chinese railway and highway construction conglomerate is also expected to build five new stations and develop a new line linking Harare with South Africa’s Beitbridge border. CRG has previously worked on major African railway projects, including the 1,860 km TAZARA line connecting Zambia to Tanzania’s ports and the Addis Ababa–Djibouti railway

Balancing Ambition and Reality

While Huayou’s $400 million plant elevates the country one notch up the lithium value chain, it is the exception, given that most companies remain reluctant to commit money to investing in beneficiation plants that are expensive to set up and operate.

The current prevailing conditions, characterized by power shortages, logistics failures, water constraints, and declining global lithium prices, make value addition untenable for Zimbabwe.

According to the latest Zimbabwe State of Mining Report, 99% of mining local miners are experiencing production stoppages and output losses due to crippling power shortages, resulting in the sector losing an estimated $500 million in potential revenue.

With the mining energy consumption expected to climb to 2,600MW a day from around 700MW, and further squeeze the national grid that already runs daily deficits of 200–500MW, the government has already asked mining companies to set up their own power generation plants by 2026,

In this context, value addition is not just costly but unsustainable for business.

Although large multinational corporations like Huayou can leverage financial muscle, most smaller operators cannot. Therefore, Zimbabwe should not treat the Huayou sulphate plant as evidence that all lithium companies will invest in building expensive processing infrastructure without the necessary conditions being in place.

Additionally, the declining lithium prices do not provide any incentive for companies to build such plants unless the government is prepared to shoulder some of the costs by subsidizing energy costs, expediting licensing of independent power producers and providing incentives to lower the costs of setting up independent power generation projects.

Pursuing blanket beneficiation without a proper cost-benefit analysis risks deepening the very vulnerabilities that have long stalled the country’s industrialisation drive.