For almost two decades, the Chinese smartphone giant behind Africa’s most popular mobile brands -Tecno, Infinix, and Itel- has grown to dominate the continent’s handset market. Now, it is making a bold move into Africa’s booming electric mobility sector with its TankVolt e-bikes, which have already become one of the top three electric motorbike brands on the continent by units sold.

Launched initially as Tecno before rebranding as Transsion, the company revolutionized Africa’s mobile phone market with custom-made devices tailored specifically for African consumers. It quickly surpassed global giants like Samsung, Apple, and Nokia, and continues to lead today. Transsion has also established an enormous presence in the mobile app ecosystem with PalmPay and Boomplay platforms which thrive due to their default presence on Tecno, iTel, and Infinix devices.

It is this deep understanding of, and success in, the African market that the company hopes to replicate in the electric mobility sector.

Building on insights from its dominant smartphone business and leveraging the needs of the African e-bike, including pricing, battery swapping and local conditions, Transsion built the TankVolt e-bike to compete with rivals on pricing while also offering flexible payment plans to enable institutions to buy the motorcycles.

It is also drawing on its experience in product localization by training local mechanics for maintenance and exploring the use of AI-powered tools to optimize performance for riders.

The BYD Playbook in Transsion’s Electric Bike Venture in Africa

Government and private fleet contracts also buoy the company’s rise to the top three motorbike brands. The company has already secured a significant deal to supply 5,000 TankVolt electric bikes to Niger State in Nigeria.

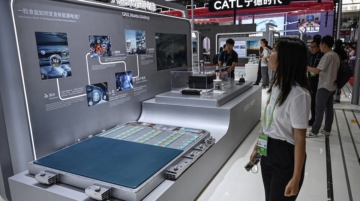

These deals give the company a potential advantage over early entrants in Africa’s electric mobility market. Additionally, Transsion is unlike most of its rivals which rely on external suppliers. Just like EV giant BYD, Transsion controls manufacturing, distribution, and financing in a vertically integrated model reminiscent of its smartphone success. This gives TankVolt a cost advantage and enables the rapid rollout of services like battery-as-a-service and fleet management software that smaller companies may struggle to replicate.

Transsion is aiming for the pole position in Africa’s electric bike market by next year. Already, TankVolt e-bikes are available in Uganda in since 2023 and then later expanded into Kenya, Ethiopia, Tanzania and Nigeria. Just as with the African mobile phone market, where it entered later, Transsion identified the shortcomings and then developed a product that was significantly better than what competitors could offer. It continued to iterate on that product which ultimately left rivals unable to catch up.

With the electric motorcycles now, it appears that Transsion has spotted another opening in the market, where even though it’s not the first, it does have some distinct advantages – namely that it has more than a decade of insights into precisely what Africa’s young consumers want and that it has the means to offer the products at slightly lower prices than what is in the market. What Transsion did for mobile communications, it now wants to do with mobility.

By leveraging its deep distribution networks and strong brand recognition of its flagship handsets, Transsion is likely to disrupt the e-bike sector, considering that the Shenzhen-based company is selling its TankVolt e-bikes at $1500, which is slightly cheaper than Ampersand’s $1,600. Roam’s Roam Air is selling at $1,500 while Spiro’s range of bikes sells for between $1,150 and $1,470.

For context, the average bike rider in a city like Nairobi earns about $250 per month. This means that individual riders would struggle to afford the e-bikes outright. This partially explains why Transsion is partnering with the government and other institutions to increase uptake.

The Tecno, Infinix and Itel Playbook

Transsion started with phones in Africa, and last year, the company shipped 9.3 million smartphones to the continent, representing approximately 50% of the market share.

This is the same success the company seeks to replicate in the e-bike sector.

Transsion is offering both built-in (integrated) and swappable battery options. Some models have batteries permanently housed within the frame, while others allow for the removal and replacement of the battery. While this is not a central selling point for many e-bikes, the company is leasing batteries to third-party charging stations. These leasing companies pay a monthly fee, which is currently happening in Tanzania and will soon in Uganda. This design is to make it easier for riders to stay on the move without spending too much time waiting for their batteries to charge.

Across the continent, charging infrastructure remains a challenge, and building a large enough network will determine whether Transsion successfully recreates its phone success across the continent, given the different dynamics in the e-mobility sector, including policy.

A potential challenge for Transsion lies in pricing. If resellers get the TankVolt e-bikes at $1,500, profit margins could drive up retail prices. This will make the bikes significantly more expensive for end users. Should that happen, it remains to be seen how Transsion navigates a scenario where affordability, a key part of its strategy, becomes a liability.