In a global context marked by climate urgency and transition to cleaner energy, green hydrogen—a fuel produced by splitting water into hydrogen and oxygen using renewable energy—has emerged as a strategic vector for decarbonization.

Unlike solar or wind power, which directly generates electricity, green hydrogen stores energy in a form that can be transported and used across sectors such as transportation (including fuel-cell vehicles), industry, and power generation, especially in areas difficult to electrify. This capability makes it a key component in the climate transition, complementing other renewables by providing flexibility and storage.

Latin America, rich in renewable resources like solar and wind, has become a key destination for Chinese investment in green hydrogen production. The process typically involves using solar or wind energy to power electrolysis, which splits water molecules to produce hydrogen gas without emissions. For instance, Chile exploits its abundant solar irradiation in the north to power electrolysis plants, producing green hydrogen for domestic use and export.

China began actively entering the Latin American hydrogen space around 2023, leveraging bilateral agreements, competitive financing, and technological cooperation. In contrast, the United States and the European Union were initially slower to respond with fragmented or inconsistent policies. Under the Biden administration from 2021 on, both Washington and Brussels increased diplomatic and financial efforts to engage Latin American countries on green hydrogen, though some initiatives faced interruptions or delays during previous U.S. administrations, such as under Trump.

The absence of a unified policy in the region could limit Europe’s ability to effectively promote and implement green hydrogen initiatives, given that Latin America faces particular challenges that require strategies tailored to its context.

Thanks to its early initiatives and considerable investments, Beijing is set to strengthen its influence in shaping Latin America’s energy landscape, posing a challenge to the longstanding dominance of the U.S. and EU in global clean energy governance.

For instance, diverse local economies rely on fossil energy sources and lack sufficient infrastructure. Therefore, the prudent stance of the European Union reflects the need to carefully consider local circumstances before making significant investments; understanding these particularities is fundamental to analysing the evolution of global energy diplomacy.

China’s growing presence has prompted Washington and Brussels to enhance cooperation, agreements, funding packages, and technology exchanges in Latin America. However, U.S. trade policies such as tariffs on clean energy components from Beijing have reshaped supply chains, encouraging Beijing to deepen ties with Global South partners, including Latin American countries, as alternative avenues for resource security and market expansion.

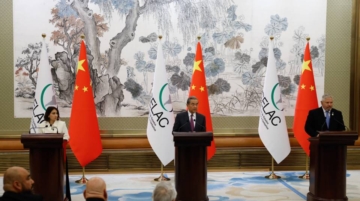

A landmark moment was the China-CELAC Ministerial Forum in Beijing in May 2025, where Brazil, Chile, and Argentina signed agreements with China on clean technology development, infrastructure financing, and green hydrogen certification standards. This forum highlighted China’s role as a central actor in South-South energy cooperation.

Chile exemplifies this trend with plans to reach 25 GW of renewable capacity by 2030, leveraging its favorable solar conditions. Prominent projects such as Oasis de Atacama, led by Spanish company Grenergy in partnership with Chinese firms like BYD, aim to build large-scale solar and energy storage infrastructure as foundations for hydrogen production. China’s investment in Chile’s energy sector already exceeds $1.5 billion, including acquisitions of companies like Pacific Hydro (by SPIC) and CGE (by State Grid Corporations of China).

In Argentina, China links lithium mining with future hydrogen production. The solar-powered lithium chloride plant inaugurated by Ganfeng Lithium in Salta in early 2025 is designed to facilitate integrated clean energy and hydrogen supply chains.

Brazil’s abundant natural resources and agro-industrial base position it to become a major green hydrogen producer, potentially supplying 10% of the global market by 2050. The Pecém export processing zone project, approved in 2024, and partnerships announced during President Lula da Silva’s 2025 visit to China—such as Envision Energy’s US$1 billion investment in sustainable aviation fuels—demonstrate growing Sino-Brazilian cooperation in hydrogen and renewable energy innovation.

Green hydrogen’s relevance also extends to fertilizer production, where hydrogen is a critical input. Transitioning to green hydrogen-based fertilizers can reduce the sector’s carbon footprint, linking energy transition efforts with agricultural sustainability.

The growing collaboration between China and Latin America offers significant opportunities to diversify the region’s energy mix and integrate into global clean technology markets. Thanks to its early initiatives and considerable investments, Beijing is set to strengthen its influence in shaping Latin America’s energy landscape, posing a challenge to the longstanding dominance of the U.S. and EU in global clean energy governance.