Chinese researchers and firms are accelerating the race towards the next generation of battery technologies, and this will undoubtedly reshape the fortunes of countries heavily reliant on cobalt and nickel exports.

Today, most electric vehicles utilize lithium-ion batteries that are made from a combination of nickel, manganese, and cobalt (NMC). While they are widely used, they are, however, costly, reliant on materials mined in politically unstable regions, and vulnerable to supply chain disruptions.

Cobalt, for example, is central to many cathodes but is expensive and environmentally damaging to mine, and it is concentrated in the Democratic Republic of Congo, one of the world’s most unstable countries.

Nickel, too, is primarily found in just one country, Indonesia, which has just under half of the world’s total reserves.

LFP’s Rise and the Push for Next-Gen Alternatives

New research in China suggests that the world may not require as much nickel and cobalt in the future. Scientists and companies have made significant advancements in cobalt- and nickel-free cathodes, such as lithium iron phosphate (LFP) and lithium-sulfur, as well as silicon-based anodes and sodium-ion alternatives.

Although automakers initially avoided LFP batteries in favor of NMC batteries, which offer higher energy density and longer driving ranges, many are now adopting LFP technology. The shift is driven by LFP’s lower cost, improved safety, and longer cycle life, despite its generally shorter range. LFP batteries also rely on iron and phosphate, which are inexpensive and abundant, unlike cobalt and nickel.

The world’s largest battery maker, Contemporary Amperex Technology (CATL), unveiled an upgraded version of its Shenxing battery this year, designed to increase range with fast charging.

CATL stated that the battery can now provide 520 kilometers of range with just five minutes of charging time. Similarly, BYD’s Blade Battery has also increased energy density for LFP, which was once a weakness compared to NMC.

Again, during the International Automobile Exhibition Summit, the world’s largest mobility trade fair held this week in Munich, Germany, CATL unveiled a new LFP battery design for Europe called Shenxing Pro that delivers a claimed 470 miles of range and ultra-fast charging.

The years of research by Chinese battery makers have further improved the performance of LFP batteries, which now account for nearly half of the global EV market. Today, they are about 30% less expensive than their main competitor, lithium nickel cobalt manganese oxide (NMC) batteries.

Sodium-Ion and Lithium Metal Research Signal a New Era

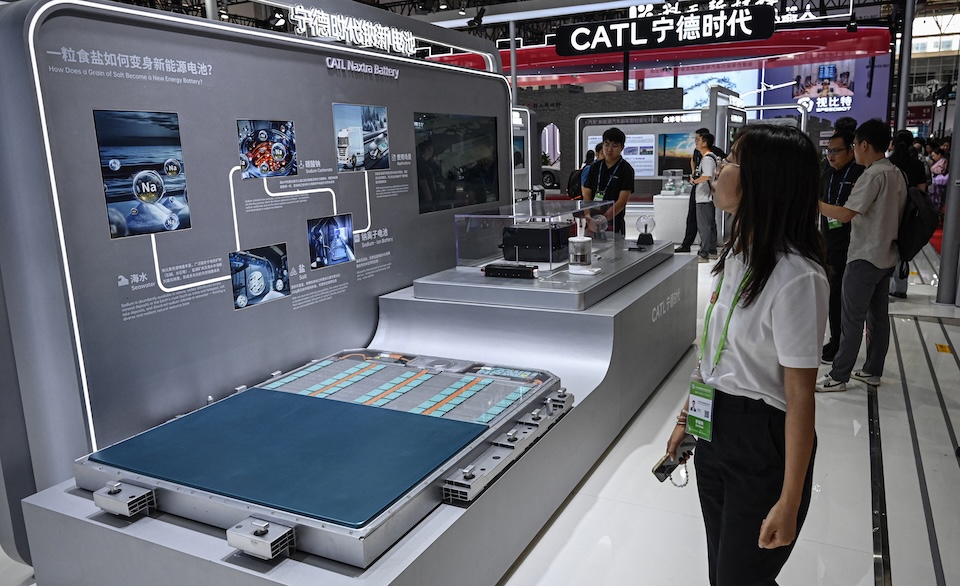

Beyond LFP, CATL is also expecting mass production by December 2025 of its Naxtra, a sodium-ion battery line with better energy density.

The sodium-ion battery does not require lithium or cobalt, but its main ingredient is, soda ash, which is much more abundant and evenly distributed worldwide and can be sourced cheaply. Another key component for sodium-ion batteries is cathodes that use materials which experts say are cheaper to produce than some lithium cathodes.

Iron and manganese, which are also key ingredients for sodium-ion batteries, are also cheaper and more abundant than nickel and cobalt, which are not readily available and concentrated in a few countries.

Because sodium is widely available globally, it is less susceptible to supply manipulation or geopolitical tensions than materials like cobalt, nickel, and lithium. Although sodium batteries currently have lower energy density and are heavier than NMC and LFP batteries, ongoing research could deliver breakthroughs that make them more competitive and potentially preferred in the future.

Beyond these corporate battery innovations, Chinese universities are also making significant breakthroughs in this field. Scientists at Tianjin University in northeastern China have developed a high-energy lithium metal battery with an energy density two to three times greater than that of existing lithium-ion batteries.

Another research team at Xi’an Jiaotong University in central China recently achieved a breakthrough in sodium-ion technology, developing a low-temperature pouch battery that can operate normally even at –40 °C.

This technological advancement not only provides a reliable energy solution for small electric vehicles and large-scale energy storage systems but also takes a key step towards the commercial application of sodium-ion batteries.

The implications for commodity-dependent economies are stark. Export revenues from lithium and cobalt have become central to fiscal planning in several critical resource-producing countries, including the DRC, Zimbabwe, Indonesia, and Chile.

Some governments now require mining companies to refine or process minerals locally, aiming to capture more value before export. But these policies overlook the possibility that in a few years, today’s ‘strategic minerals’ may lose their premium as new, alternative technologies emerge.

The longer governments in cobalt, nickel, and lithium-producing countries take to recognize this shift, the more exposed they will be to commodity price fluctuations as demand for these minerals declines. Some countries, such as the DR Congo, are beginning to acknowledge the challenge, but concrete action to prepare remains limited.

While it is understandable that producer countries want to maximize benefits from mineral revenue and industrialize, they may miss the opportunity by focusing on demanding value addition and building processing facilities tied to materials that will undoubtedly be phased out in the coming years.

Commodity-Dependent Economies at a Critical Juncture

The lesson policymakers in producing countries should take from these emerging battery technologies is that chemistry can change faster than politics.

Critical mineral-producing countries should take additional steps to prepare their economies, utilize mineral revenue to bolster other economic sectors, invest in infrastructure, and conduct research and development for new minerals to support future growth.

If they do not invest in research for new technologies, these countries will continue to find their fiscal capabilities undermined.

Battery innovators in China, Japan, Europe, and other regions will continue to test new technologies that accelerate the decline in demand for cobalt, nickel, and lithium, thereby eroding future revenues for mineral-exporting countries.

The problem is that many producer countries are prioritizing value addition at the wrong end of the supply chain, missing the chance to prepare for future minerals essential to industrial development.

At the same time, too little attention is given to minerals critical for food security, such as limestone, phosphate, and potash, despite their looming crisis in many mineral-producing nations.

Although value-added policies may help in the short term, they will not shield countries from future disruptions unless governments prepare their countries by putting in place the necessary energy infrastructure and investing in tertiary institutions to build the skills base for future minerals. Governments could also start to develop partnerships with foreign mining companies in which they embed requirements for companies to partner with research entities and build capacity of local graduates.