Bolivia’s presidential elections have thrown the future of its lithium sector into doubt — and the country’s relationship with China has gone along with it. The first round of voting in late August ended two decades of rule by leftist party Movimiento al Socialismo (MAS), and now, the country will decide its next president in a runoff election between centrist Rodrigo Paz or right-wing former president Jorge Quiroga.

Both candidates have publicly criticized Bolivia’s recent lithium contracts, which notably include billion-dollar deals with Chinese battery giant CATL. The developments in this election signal that Bolivia may soon rethink how it wants to develop its vast lithium reserves — as well as the role that Beijing will play in that process.

The Lithium Triangle

Bolivia is in the middle of the Lithium Triangle, a part of South America spanning Chile, Argentina, and Bolivia that holds between 60% and 75% of the world’s known lithium reserves. Most of the lithium in the triangle is concentrated in salt flats: Uyuni in Bolivia, Atacama in Chile, and Hombre Muerto in Argentina.

Lithium is a critical mineral essential for energy transition as it is one of the key components for the batteries that power electric vehicles. But in terms of production, Bolivia lags behind its neighbors. While Chile and Argentina’s yearly output are at 140,000 and 33,000 tons, respectively, Bolivia’s production in 2023 was just 600 tons.

One of the reasons for this is that Bolivia’s lithium deposits are technically complex, making extraction projects particularly difficult given the spiraling costs, insufficient infrastructure, and shortage of qualified labor. Critics also point to chronic mismanagement, high environmental costs, and political instability as barriers to competitiveness.

Enter CATL

In late 2024, there were some hopeful developments. Bolivia signed a $1 billion deal with a Chinese consortium led by Contemporary Amperex Technology Co., Limited (CATL), a global lithium-ion battery manufacturing superpower, to build two direct lithium extraction plants in the Uyuni salt flats.

According to the head of YLB, Bolivia’s state lithium company, those plants will increase Bolivia’s yearly lithium output to 35,000 tons.

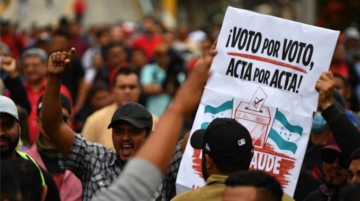

However, this deal, along with another involving Russia’s state-owned company Uranium One, has provoked significant backlash among the public, fearing threats to Bolivia’s sovereignty (although once completed, YLB will retain a 51% stake in the projects), lack of transparency around the contracts, and human rights concerns.

Indigenous groups argue that those deals violate their environmental rights. Others believe that the deals offer unfavorable conditions for Bolivia and that they were allowed to proceed without formal consultations.

Discussions have raged in Bolivia’s congress, and a court even ordered the suspension of the deals.

Presidential Elections

Both Paz and Quiroga have expressed concern about the deals. Paz, the centrist frontrunner, has pledged to review the contracts, saying that “no one knows about them” and insisting that without clarity, transparency, and a direct dialogue with the Bolivian people, it will be very difficult for the contracts to be approved.

For his part, right-wing former president Quiroga has taken even a tougher stance. He has vowed to scrap both extraction deals and seek alternative investment partners. He also claims that Uranium One and CATL were selected “behind the back” and said that a new law on mineral deposits was needed to preclude favoritism.

In its October 19 runoff, Bolivia will elect its first leader in 20 years who is not from the left. Regardless of whether Paz or Quiroga takes the office in this election, China will feel its effects. For Beijing, the outcomes range from a more distant, arms-length relationship under Paz, to outright confrontation under Quiroga.

Bolivia may not yet have the capacity to industrialize its lithium sector alone, but its choices will shape the geopolitics of the Lithium Triangle, and with it, the future of the critical minerals trade.

Alonso Illueca is CGSP’s Non-Resident Fellow for Latin America and the Caribbean.