By Clyde Russell

Two multi-billion-dollar rail projects in Africa. One headed west, the other east. One backed by Western countries, the other by China. Both are aiming to ship vast quantities of critical minerals. Welcome to the new scramble for Africa.

The Lobito rail corridor will cost up to $6 billion and is planned to be finished by 2030, with around 1,700 kilometres (1,050 miles) of track carrying mainly copper and cobalt from the Democratic Republic of the Congo (DRC) and Zambia west to the Angolan port of Lobito.

Much of the funding is coming from the United States and Europe and aims to upgrade the existing railway and build new lines to boost annual capacity to 4.6 million metric tons.

Heading east to Tanzania is the TAZARA railway, a 1,860-kilometer line that links the same mineral-rich parts of Zambia and the DRC to a port on the Indian Ocean, offering shorter sailing times to China and other Asian markets.

Similar to the Lobito project, it is a rehabilitation of an existing colonial-era railway, and its Chinese backers are slated to spend around $1.4 billion to upgrade its annual capacity to 2.4 million tons.

These two projects are emblematic of how the world’s great powers are seeking to source and control the minerals needed to power industrial economies and the energy transition.

But they also show the contrasting ways Western countries and China are trying to achieve their aims of securing supply.

Stuck in the middle are African countries, blessed by their resource endowment but cursed by a lack of coordinated policies to prevent exploitation by stronger nations, as well as by too often poor governance and an inability to offer consistent, reliable investment regimes.

What is different this time compared to the colonial conquest of Africa two centuries ago is that African countries have far more choice.

They can set the rules and decide whom they want to partner with, and if they get it right, they stand to benefit from increased investment, jobs, and tax and royalty revenue.

The models being offered are slightly different, insofar as Western countries largely prefer private operators, coupled with public partnerships and funding in order to build mines and transport infrastructure.

U.S. Woos and Guaranteeing Offtake

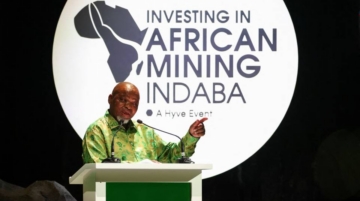

One of the major shifts at this week’s Mining Indaba conference in Cape Town was the United States changing tack, eschewing the bombastic, combative rhetoric of President Donald Trump and focusing on trade and investment.

It is perhaps a tacit acknowledgement that insulting countries that you need for their resources is not a winning policy, but U.S. officials were out in force touting their capital for investment and their willingness to effectively re-risk mining projects by guaranteeing offtake and prices.

If the United States does go down this path, and African countries can look past the prior Trump insults and gutting of U.S. aid, there is a real possibility that new mines and infrastructure will proceed.

The planned U.S. “vault” of critical minerals will need African resources and a meeting of more than 50 countries last week shows the Trump administration appears to be serious about building and securing supplies of metals.

Will the efforts by the United States, and to a lesser extent the European Union, be enough to wean African states from Chinese investment, which has tended to be more all-encompassing as Chinese companies explore, build, operate, and transport minerals?

An example is the massive Simandou iron ore mine in Guinea, currently ramping up to its 120 million tons a year capacity.

For years, the project languished as Western companies struggled to mount a viable economic plan to make it work.

But Chinese investment and technical skill have brought the project to life, albeit with a minority partner in Rio Tinto RIO.AX, and the ore from Simandou will flow almost entirely to China as a result.

The Chinese also have a strong first-mover advantage in Africa, having been active for decades.

But the question for African countries is whether China’s investment in extracting the continent’s minerals has been mutually beneficial or skewed towards Beijing.

The follow-up question is whether Western countries and their trading and mining companies will offer anything substantially better.

What is almost certain is that more investment is heading to exploit Africa’s mineral endowment, which will boost competition and de-risk projects.

Is the prize big enough to make everybody a winner? Yes, but it will take considerable effort and cooperation and the track record for that in Africa is patchy at best.

The views expressed here are those of the author, a columnist for Reuters.