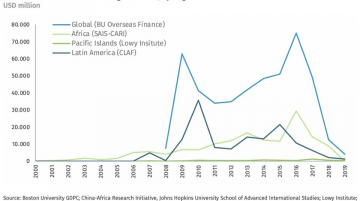

Findings from Boston University’s new database on Chinese development finance patterns that revealed a “collapse” of overseas lending sparked a lot of conversation online yesterday from leading development economists in the U.S. and Europe.

The general consensus among the experts was that the COVID-19 pandemic exacerbated a trend that had already been well underway over the past several years and that China’s risky lending habits were going to inevitably hit some kind of inflection point, given how many of the projects they funded were just financially unsustainable.