Two great railroads nearly bisect the southern central belt of Africa, stretching from the Atlantic and Indian oceans respectively, poised to shuttle key metals from the mineral-rich center of the continent to markets abroad. For Zambia, the second-largest copper exporter in Africa, these railways represent the future of industrial and economic growth, as well as a balancing act between East and West. With recent upheavals in the United States’ commitment to foreign development and tariffs roiling global markets, it’s China’s plan to refurbish the Tazara railway, which runs to the port of Dar es Salaam, that may bolster Zambia’s economic future—and China’s access to copper deposits.

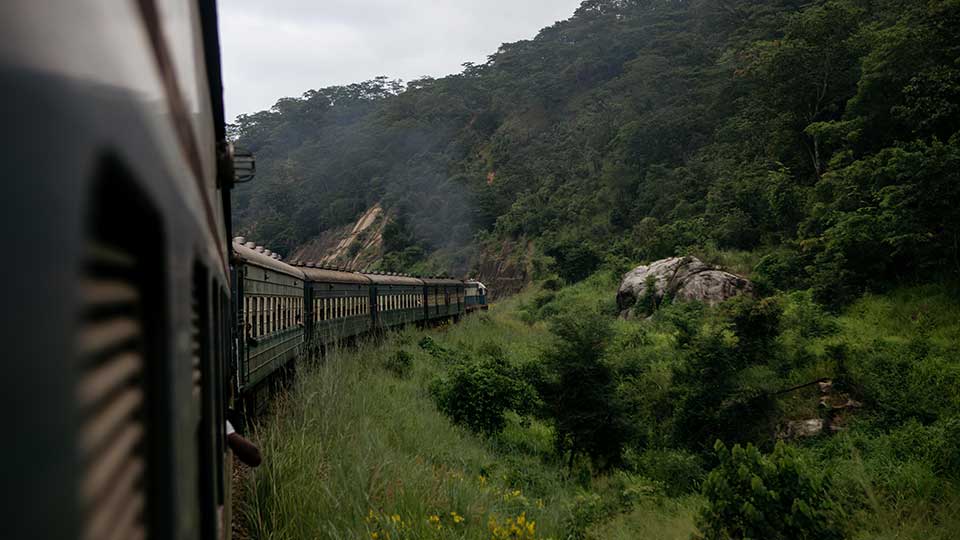

Recently, the China Civil Engineering Construction Corporation finalized a $1.4 billion investment into the aging Tazara railway, which runs from the town of Kapiri Mposhi in Zambia’s Copperbelt region to the port of Dar es Salaam on Tanzania’s coast. Originally built with Chinese financing in the 1970s, the railway transports roughly 500,000 tons of freight annually, which is far below its designed capacity of 5 million tons.

This project by state-owned CCECC will see $1 billion spent on repairing and modernizing the Tazara’s 1,860 km of narrow-gauge railway track, and another $400 million for the purchase of modern railroad cars and locomotives, with upgrades planned to be completed in two years. The Chinese will receive a 30-year concession to run the Tazara and recoup their investment, before turning the trains back over to Tanzania and Zambia. The work is projected to quadruple the Tazara’s freight capacity to 2 million tons of cargo annually.

It isn’t just the upgrades to the infrastructure that will seek to improve the Tazara’s spotty service, which is prone to delays and breakdowns. “Management is a big deal,” said E. D. Wala Chabala, an economist and former board chairman of Zambia Railways Limited. “Management and the culture that comes with it.”

Ideally, he said, Chinese oversight of operations may improve efficiency and reduce any corruption or misreporting within Tazara, though China will be unlikely to put money into repairs before handing control back to Tanzania and Zambia, after their three decades of control.

The greatly increased freight volume will be a boon to Zambian exporters, though mines have yet to reach output levels commensurate with the projected capacity. “In 2024, we saw positive growth in the mining sector, and we are hoping we can cross the 1 million [ton] psychological barrier this year,” said Paul Kabuswe, Zambia’s Minister of Mines and Minerals Development.

He stressed the need for improved infrastructure to support Zambia’s mining sector, as well as the need for a regulatory environment that is friendly to foreign investment.

Outside Serenje, in Zambia’s Central Province, Chinese corporations have been buying up mines from local owners, and numerous Chinese-owned smelting plants have sprung up in the last three years. During a tour of one of the plants, the foreman noted that while the smelters could process 500 tons of raw material per day, they were currently not running due to a power shortage, and lamented Zambia’s inadequate energy infrastructure.

“The biggest impact on the mining sector was the drought and the climate change issues,” said Kabuswe, referring to the 2024 drought that severely impacted hydropower in the country. “The drought we experienced as a country negatively impacted on energy, and as a consequence, on the mining sector,” he said. Kabuswe touted numerous energy projects underway, including solar projects, but Zambia has also approved construction of a new coal-fired power plant in response to the drought.

“I can bet my bottom dollar that once they’ve got that [Tazara] concession, the Chinese are going around getting commitments from the mining houses to transport their products. There won’t be much getting transported to the West”

E. D. Wala Chabala, economist and former board chairman of Zambia Railways Limited

Zambia’s other potential rail link to the ocean, the Lobito Corridor, appeared to be in limbo as the Trump administration slashed foreign aid and investment worldwide, but the new transactional U.S. foreign policy appears to include the major infrastructure project, which was former President Joe Biden’s key engagement with Africa during his term. According to Kabuswe, the project is “very much alive.”

The Western-led investment would include the refurbishment of the existing railway, which stretches from the Angolan port city of Lobito to the city of Kolwezi in the Democratic Republic of Congo, as well as the construction of 800 kilometers of new railway that would run directly to Zambia’s Copperbelt region, in Chingola. From there, the line could be connected to the Zambia Railways network.

In early April, U.S. diplomat James Story, currently the interim chargé d’affaires at the U.S. Embassy in Angola, made a tour of potential Lobito project sites to speak about the future of cooperation and American development aid, and taking to X, to express a “commitment to promoting prosperity through the Lobito Corridor.” This project would greatly benefit the U.S. in its campaign to secure more copper, moving both the DRC’s and Zambia’s mineral exports expediently to the Atlantic port in Lobito, and eventually, to the U.S.

But it may be too late, according to Chabala. It will take decades for the U.S. or other Western countries to achieve the level of integration across the mining and critical minerals sectors in the way the Chinese have, he argues, and Chinese-owned businesses will patronize the Chinese-controlled rail line.

“I can bet my bottom dollar that once they’ve got that [Tazara] concession, the Chinese—just like the guys at Lobito—are going around getting commitments from the mining houses to transport their products,” Chabala said. “There won’t be much getting transported to the West.”

Paul Stremple is an independent journalist and photographer based in Nairobi. Kang-Chun Cheng also contributed reporting for this story.

Reporting for this story was supported by the Pulitzer Center