By Cecilia Han Springer

2021 saw persistent economic impacts from the COVID-19 pandemic, narrowing borrowing capacities in developing countries, and a global trend towards phasing out coal. These factors converged in a shocking finding from the 2022 release of the China Global Energy Finance (CGEF) Database, managed by the Boston University Global Development Policy Center: we recorded no new energy development finance commitments from China’s policy banks to foreign governments for the first time in the 21st century.

In our new policy brief, we explain that while this is a dramatic development, it is not entirely surprising. Given the factors discussed above, it was unlikely that Chinese overseas energy finance would continue unabated. Ultimately, after having far exceeded energy sector lending by any other major development bank in the world for more than a decade, Chinese overseas lending has likely dropped to a level comparable to other national development finance institutions (DFIs), following an overall decrease in Chinese development finance since 2017.

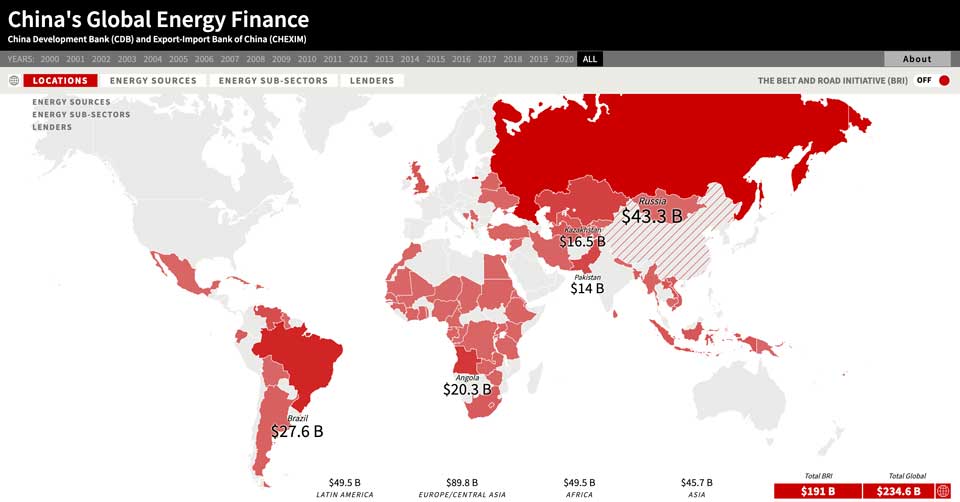

Even though there were no new overseas energy sector loans by the China Development Bank (CDB) or the Export-Import Bank of China (CHEXIM) in 2021, since 2000, the two banks have provided 331 loans to 68 foreign governments and associated entities in the energy sector, totaling $234.6 billion. This is on par with energy sector financing from all other major Western-backed multilateral development banks combined.

From 2016-2021 alone, CDB and CHEXIM provided $75.1 billion in energy finance in the form of 92 loans to 37 countries, far exceeding the next biggest energy financier among DFIs – the World Bank.

Given the lack of new overseas energy development finance from China in 2021, how then are Chinese actors engaging with the overseas energy sector? While overseas energy development finance has decreased year by year since 2017, on average, China’s foreign direct investment (FDI) in the form of greenfield investments and mergers and acquisitions (M&As) in the energy sector have remained relatively stable, with FDI gradually becoming China’s dominant means of capital participation in the energy sector overseas.

There has also been a structural shift in the composition of China’s energy FDI, with the electricity sector playing a larger role in recent years. Importantly, FDI for fossil fuel power generation peaked in 2015, while greenfield FDI in the electricity sector has increasingly been oriented towards alternative and renewable energy. Considering Chinese leader Xi Jinping’s commitment last September to stop building new coal power projects overseas, investment in fossil fuel-based power generation is likely to further decrease.

So, is 2021 an outlier year marred by pandemic and global financial instability, or is this the new normal for Chinese overseas energy development finance?

The possibility remains Chinese development finance could rebound in the coming years. With China’s continued emphasis on energy cooperation, especially green energy, it is not likely China will cease its leadership in global energy finance. And with key roles in guiding and supporting China’s foreign investment and international economic cooperation, CDB and CHEXIM will remain leaders of China’s overseas development engagement. Additionally, recent research indicates a significant relationship between Chinese outbound policy bank finance and international reserves, which have begun to rebound substantially amid record trade surpluses.

Given the increasing focus on a green Belt and Road Initiative, one thing is clear: if and when Chinese development finance for overseas energy increases again, it should be directed towards cleaner sources of energy to match the trends in FDI, policy announcements, and global goals for mitigating climate change.

Explore the data and let us know your thoughts: gdp@bu.edu.

Cecilia Han Springer is the Assistant Director, Global China Initiative at the Boston University Global Development Policy Center.