The global copper market is at a pivotal moment, and China sits squarely at its core. In recent weeks, copper prices have slid sharply, rattling commodity markets and dragging down the share prices of major copper mining companies across the globe. This downturn reflects growing investors’ anxiety and China’s dominance, the world’s largest consumer and processor of copper, combined with concerns about rising global supply and intensifying geopolitical risks.

Chinese copper stockpiles have been declining significantly. According to Nicholas Snowdon, Mercuria’s head of metals and mining research, who spoke to Financial Times, the current Chinese copper inventories could deplete to zero by the middle of June 2025.

Further, copper prices on the London Metal Exchange have dipped below $8,500 per metric ton—a notable drop from the highs seen in 2024. Meanwhile, the share values of leading producers like Freeport-McMoran, Glencore, and First Quantum Minerals have stumbled.

Yet despite these immediate headwinds, China’s long-term dominance over global copper supply chains remains unshaken. A recent analysis on the global copper market share revealed that China and countries it has major copper mining projects (Zambia, DRC, Indonesia and Iran) control 53.1% of the world’s copper, while the U.S. and its allies only controls 15.6%. China is positioning itself as the epicenter of copper value chains through vast smelting operations, aggressive overseas mine investments, and tight control of refining infrastructure.

China’s growing influence presents both opportunities and mounting risks for copper-rich countries—especially in Africa, Latin America, and parts of Asia. Producers must carefully navigate a rapidly shifting landscape as geopolitical tensions rise and global trade becomes increasingly fragmented.

The Coming Production Surge

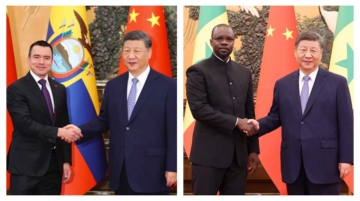

At its latest meeting in Lisbon, the International Copper Study Group (ICSG), an intergovernmental organization of copper-producing and consuming countries, projected global copper mine production to grow by 2.3% in 2025, reaching 23.5 million metric tonnes (Mt). This surge will be led by expansions in the DRC’s Kamoa-Kakula mine, Mongolia’s Oyu Tolgoi, and Russia’s Malmyz project. By 2026, production is forecasted to rise another 2.5%, with ramp-ups in Chile, Zambia, Indonesia, and new projects in Brazil, Ecuador, Eritrea, Angola, and Morocco.

Refined copper output is expected to grow even faster—2.9% in 2025—thanks largely to new smelting capacity in China, Indonesia, India, and the DRC. However, growth will likely slow to 1.5% in 2026 due to tighter concentrate availability.

Demand Still Outpacing Supply

However, most importantly, copper demand outpaces supply. Under the most optimistic mining forecasts, there will be a significant copper supply shortfall by the end of this decade. The International Energy Agency sees a potential gap of 4.5 million metric tons by 2030 in its most aggressive clean energy scenario. Even the base case shows the world will need 80% more copper by 2040 just to meet the world’s current policy targets.

The Geopolitical Tangle: Tariffs and Trade Fragmentation

China’s dominance in copper processing is running headlong into intensifying trade tensions. Earlier last month, U.S. President Donald Trump commissioned a review into strategic minerals, including copper, targeting imports from China and other nations deemed to engage in “unfair trade practices” or posing “supply chain vulnerabilities.”

The risk of indirect exposure to U.S. duties is real for Global South producers whose copper concentrates are often processed in Chinese smelters before being re-exported.

Similarly, countries banking on Chinese-backed smelters to upgrade their value chains should start reassessing whether their downstream exports might face barriers under Washington’s evolving trade regime.

Far from retreating, China has been doubling down for a while. With U.S. tariffs and shifting geopolitics, Chinese companies are accelerating joint ventures to build smelters closer to mine sites in Africa and Latin America.

Flagship projects in Indonesia and the DRC, where Chinese entities are co-financing large-scale refineries, are designed to capture more value locally and lock in long-term offtake agreements. While such projects offer producing countries infrastructure and processing capacity, technology control, financing terms, and export routes often remain under Beijing’s tight grip.

What’s at Stake for the Global South?

The next two years offer unprecedented opportunity and daunting risk for copper-rich nations in the Global South. On one hand, surging global production, especially from newer, smaller mines in regions like Angola, Eritrea, and Morocco, suggests a more diversified supplier base.

On the other hand, the bifurcation of global trade, with U.S.-centric and China-centric supply chains pulling in opposite directions, could force governments into difficult strategic choices. Aligning too closely with one bloc risks alienating the other; trying to balance both may expose producers to unpredictable tariffs, financing constraints, or diplomatic frictions.

This means that for countries with significant Chinese copper projects, strategic positioning is key, but there ought to be caution.

The global copper crossroads is not just about volumes of ore pulled from the ground — it is about who controls the chokepoints, who captures value, and which nations secure a long-term stake in the industries powering tomorrow’s economy.

And in that contest, China’s head start gives it a formidable advantage.