Chinese military engagement in Africa is rapidly expanding across all fronts. From peacekeeping deployments and military training programs to private security firms and dual-use infrastructure, Beijing’s approach to African security is layered, evolving, and at times opaque. But it’s not clear if there’s a grand strategy at play or if Chinese military planners are merely adapting in real-time to fast-changing security conditions across the continent.

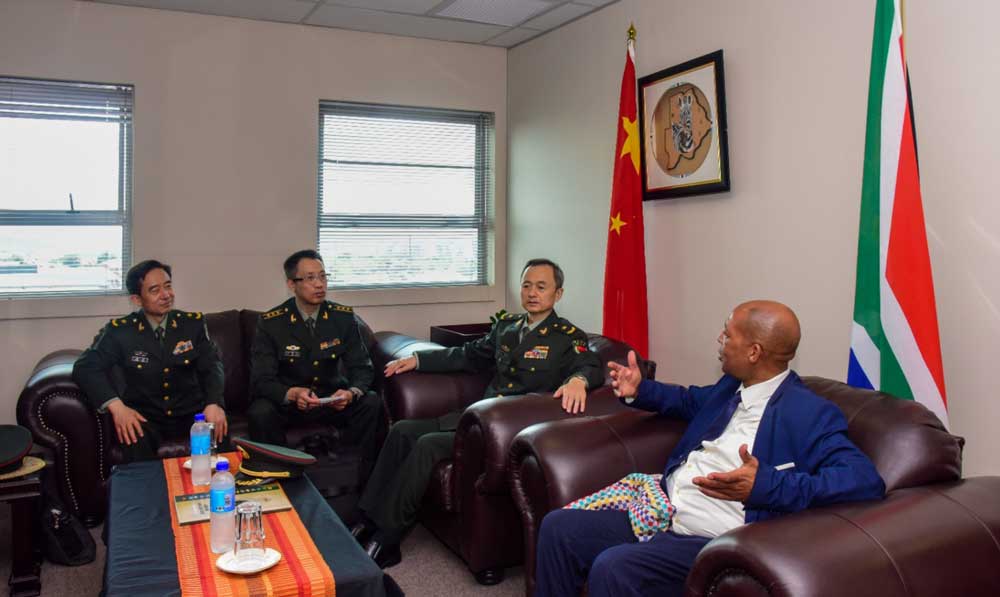

In this conversation, China-Africa Security Radar editor Lungani Hlongwa sits down with Paul Nantulya, a veteran analyst at the Africa Center for Strategic Studies, to unpack the complexities of China’s security engagement across the continent. Drawing on two decades of policy documents, case studies, and field observations, Nantulya explains how Beijing combines long-term planning with tactical flexibility, employing the old Communist Party saying “crossing the river by feeling the stones” (摸着石头过河).

This interview, edited lightly for clarity, explores China’s strategic calculus and how African states are responding. While some governments welcome Beijing’s hands-off approach and promises of “win–win” cooperation, others are raising concerns over Beijing’s scattered approach and the uneven distribution of benefits.

LUNGANI HLONGWA: How is China responding to the variety of security challenges in Africa? Does it have a coherent strategy, or is it learning and adapting as it goes?

PAUL NANTULYA: I would say both. China has formal policy documents that clearly outline its Africa strategy. The first official China–Africa policy paper came out in 2006, followed by others in 2015, 2018, and 2021. These, along with its Five-Year Plans and white papers on peacekeeping, Africa, and world affairs, provide a structured policy architecture.

If you examine those documents and compare them with China’s actual activities on the continent—military cooperation, training, infrastructure support—there’s a high degree of consistency. So yes, China does have a defined Africa policy, including in the security domain.

However, Chinese engagement is also quite adaptive and can be confusing to track. There’s a lot of flexibility built into how they operate. China tailors its approach based on the local context, including the country’s strategic importance, the nature of the government, the level of political stability, and other factors—such as the level of pushback they encounter. You see this in how Chinese embassies, companies, and even military actors behave differently depending on the country they’re in.

The Chinese often describe their foreign-policy approach as “crossing the river by feeling the stones.” That metaphor really fits here.

If they encounter pushback or regime change, they adjust quickly. Zimbabwe is a good example.

When President Mugabe was removed by the military, many expected a disruption in Sino-Zimbabwe relations. But China worked behind the scenes to ensure that the government that orchestrated the coup would be on good terms with them and choose to deepen their ties rather than alienate China.

We’ve seen this in Burkina Faso, Guinea, Mali, Niger, and Sudan.

However, things don’t always work to China’s liking, as can be seen in the problems it now faces with the junta in Niger, which is unilaterally changing the rules in ways that have imperilled Chinese investments and made the environment in which Chinese firms operate highly volatile and unpredictable—all this, even though the regime continues to be highly dependent economically and politically on China. It is surely unsettling for Beijing at this point, and I suspect it will prompt a policy rethink sooner rather than later.

Be that as it may, China has gotten used to casting its net wide. We’ve seen this in places such as Kenya and Zambia, where leaders sometimes campaign on anti-China platforms, but once in power, they often deepen ties with Beijing. China can work hand-in-glove with governments, but when new ones come in, it can shift gears and build relations with the new authorities.

That said, there are growing concerns within China about the security of its nationals and investments overseas. Think tanks affiliated with the Ministry of State Security have written extensively about threats to Chinese assets abroad. So, the security element of China’s Africa engagement is becoming more prominent.

However, I don’t think there’s a single, agreed-upon strategy within the Chinese government on how best to manage these risks. They’re still experimenting—using a mix of peacekeeping contributions, security firms, partnerships with host-country forces, and, in some cases, naval assets for evacuations. We’ll see how this develops in the coming years.

LUNGANI: What specific tools or mechanisms does China use to advance its security interests in Africa?

PAUL: China uses a layered toolkit. The most visible one is peacekeeping. China is the largest contributor of peacekeepers among the UN Security Council permanent members and deploys almost exclusively to Africa—Mali, South Sudan, and the DRC.

Their deployments are not just symbolic; Chinese troops have taken on engineering and medical roles and, in some cases, more robust operations.

Then there’s military diplomacy. Chinese defense attachés are active across the continent. They facilitate exchanges, training programmes, and high-level military visits. Some African officers are trained in China, and Chinese instructors sometimes conduct training on the continent itself.

Another tool is the China–Africa Peace and Security Forum, which has now been institutionalised. These forums serve as platforms for dialogue, while also acting as mechanisms for aligning views, building trust, and showcasing China’s role as a security partner.

There’s also growing use of Chinese security firms (CSFs). These firms, often made up of ex-military or police personnel, provide protection for Chinese nationals and projects. While they’re not as prominent as Western firms, their presence is growing—particularly in high-risk areas such as Nigeria or South Sudan.

At a more strategic level, China has introduced initiatives like the Global Security Initiative (GSI), which outlines a Chinese vision for international security governance. While the GSI is still broad and somewhat abstract, it is becoming more concrete, signalling Beijing’s ambition to shape the norms and rules of global security—and Africa is a key testing ground.

They’re also leveraging dual-use infrastructure. Ports, telecom networks, and data centres built by Chinese companies have potential military applications. This doesn’t mean they’re actively being used for that purpose, but the possibility exists, and that’s something many other countries are watching closely.

LUNGANI: How do African states perceive China’s growing security role?

PAUL: African governments tend to welcome China’s involvement. Beijing comes in with fewer political conditions, which many leaders find appealing. China frames its support around sovereignty and mutual respect—concepts that resonate, especially in countries with histories of foreign military intervention or conditional aid.

At the same time, China is careful not to overextend. It avoids direct military entanglement and limits the exposure of its armed forces. This caution comes from concerns about capacity, reputation, and the strategic cost of failure. China is very risk-aware when it comes to the PLA.

On the other hand, China is capitalising on a narrative and perception that its major competitors—Africa’s traditional development partners—are scaling down or retreating. There continue to be concerns within the African Union (AU) that traditional partners’ engagement is becoming narrower, focusing primarily on counterterrorism and competition with China, rather than on long-term partnerships based on mutual interests. During AU summits, officials often remark that the continent tends to be viewed through the lens of crisis rather than opportunity. This reinforces the perception that Africa is a problem to be fixed rather than a partner that offers serious opportunities, despite the risks.

In some cases, local Chinese actors—whether businesspeople or diplomats—will coordinate directly with African security agencies. They’ll work out arrangements for police protection or intelligence sharing. It’s ad hoc but increasingly common.

Meanwhile, countries such as Indonesia, India, and China tend to project the opposite: optimism. They speak the language of win–win cooperation, infrastructure, industrialization, and modernization. Even when reality doesn’t always live up to the rhetoric, the message resonates, and they know this. African elites often find it more empowering—and China, to be sure, is not the only one that uses such rhetoric.

Of course, ordinary citizens may have a different view. There are growing concerns about debt, labour practices, and environmental impact when it comes to China specifically. But among African elites—the policymakers and security actors—China is seen as a serious and increasingly credible partner.

LUNGANI: You mentioned China’s flexibility. How exactly does it adjust to different political contexts across Africa?

PAUL: Despite its policies of regime consolidation, China doesn’t get overly invested in individual leaders or political factions to the extent that it extinguishes all its options. When there is a change of government, China recalibrates quickly, as we saw in Angola and as we see in places like Mozambique, Kenya, Senegal, and those experiencing unconstitutional changes of government. Incidentally, some Chinese state think tanks have developed this as an area of study: they look at the new or impending power structure, assess the level of continuity, and then make proposals on how to maintain or rebuild relationships.

There’s a kind of internal ranking system that informs how China engages with African countries. It doesn’t always work perfectly, but it is in place. Factors such as mineral wealth, geographic location, political alignment with Beijing, and market size determine the level of investment and attention.

Countries with high strategic value—like Nigeria, South Africa, or Ethiopia—receive more senior visits, infrastructure projects, and military cooperation. There is logic to it: if one can sort out the noise from the details, find indicators and track them over a long period—and learn and work in Chinese, which, in my opinion and experience, is paramount; there are no shortcuts.

China also doesn’t try to control everything, despite the image that it does. Instead, it builds redundancy into its approach. If one avenue closes—say, a leader is overthrown or a project encounters local resistance—China pivots to another actor or sector.

It’s also constantly learning. Chinese companies, diplomats, and think tanks are collecting data and assessing what works and what doesn’t. They publish internal reports and policy briefs, often produced by semi-governmental institutions, that feed into Beijing’s broader Africa strategy.

So, while it may seem ad hoc from the outside, there’s a lot of institutional learning and adaptation going on beneath the surface.

LUNGANI: How coordinated are the different Chinese actors—government, state-owned enterprises (SOEs), private firms—when it comes to security engagement in Africa?

PAUL: It’s not always tightly coordinated, especially at the operational level. What you often see is alignment at the strategic level but fragmentation at the point of execution.

The Chinese state sets broad policy goals and priorities. These might include ensuring the safety of overseas personnel, protecting investments, or strengthening diplomatic ties. Then you have SOEs, private companies, and even provincial actors interpreting those signals and acting in ways that align—more or less—with the national interest.

But there’s a lot of improvisation. For example, if a Chinese company faces a local security threat, it may hire a private security firm or request assistance from the Chinese embassy, depending on the urgency and sensitivity of the situation. These decisions are often made in the field and aren’t always coordinated with Beijing in real time.

In some cases, local Chinese actors—whether businesspeople or diplomats—will coordinate directly with African security agencies. They’ll work out arrangements for police protection or intelligence sharing. It’s ad hoc but increasingly common.

What ties it all together is the concept of “comprehensive national security,” which is central to Xi Jinping’s thinking. This idea extends beyond traditional military threats to include economic, political, environmental, and even cultural dimensions. So, when a telecom company like Huawei builds infrastructure in Africa, that’s not just business—it’s part of China’s broader strategic footprint.

Similarly, when China builds police-training centres or donates surveillance equipment, those actions serve both bilateral and internal security interests. They help the host country manage domestic threats, but they also protect Chinese nationals and assets—and reinforce Beijing’s image as a reliable partner.

LUNGANI: Given everything we’ve discussed, what do you think China’s long-term vision is for Africa—and what space is there for African agency within that vision?

PAUL: China sees Africa as central to the future of the international order and as essential to the kind of global system it wants to reshape. In Beijing’s eyes, the world is going through a major transition—a “great change unseen in a century,” to borrow their phrase. Africa plays a key role in this transformation, not just as a market or resource provider but as a geopolitical partner. To understand Africa’s importance to China, one needs to review recent history.

In the 1950s through the 1980s, China’s Africa policy was predicated on what we might call the “high politics of global competition,” as Beijing viewed the continent as the primary location of its worldwide anti-imperialist struggle. After the Cold War ended, China’s Africa policy became largely economic, with Beijing consumed by domestic modernisation; Africa contributed little to those endeavours.

From the late 1990s onward, however, China’s Africa policy swung back to the “high politics of global competition” and has remained so ever since. This emphasis has intensified and will likely continue. Hence, China’s engagement in Africa is at heart political, but it is also comprehensive and globally focused, meaning that Africa fits into a larger Chinese global perspective. China doesn’t engage Africa in a piecemeal fashion.

Indeed, if you study the six regional forums for Chinese engagement—such as FOCAC for Africa, CELAC for Latin America, and CASF for the Middle East—you’ll be struck by the similarities of approach, institutional structure, conceptual framing, and their respective three-year planning cycles and strategic pillars. They are almost mirror images of one another, tied together by a common Chinese global strategy, ambition, and logic.

This means that any competitive strategy against China must be global and must account for the comprehensive nature of Beijing’s regional engagements. Approaching Africa in a disconnected fashion—assuming that what happens in the South China Sea has no bearing on Africa—misses the point and misunderstands the foundations of Chinese foreign policy.

I will conclude by noting that Africa, along with other regions of the developing world, has been considered the “foundation” of Chinese global strategy and the international architectures that Beijing has built since the late 1990s. African countries are not just important voting blocs in multilateral forums; they are partners in China’s effort to construct parallel international institutions and reshape the current global order.

Initiatives such as the Belt and Road, the Global Security Initiative, and the Global Development Initiative are all anchored in these efforts.

In some cases, China actively creates new intergovernmental organisations—take the International Organization for Mediation, for example, in which African countries supplied most of the founding and prospective members.

In other situations, Beijing starts with norm-creating initiatives and then builds institutional elements over several years; the Global Security Initiative is one such example. We shouldn’t dismiss it as an “amorphous concept.” A careful study shows it gaining concrete form through aspects of China’s overseas security assistance in Africa.

So, Africa isn’t peripheral to China’s strategy—it’s both a testing ground and a proving ground for China’s long-term global institution-building efforts.

That said, African agency is real—but it varies. Some governments are very good at negotiating with China. Ethiopia under Meles Zenawi was one of the best: it used Chinese investment strategically and made clear demands. Rwanda, in a different way, has also exercised strong agency, as has Algeria. But not all countries can do that; some are too weak institutionally or too fragmented politically to shape the terms of engagement, and in those cases, the asymmetry in the relationship becomes more pronounced.

Still, the relationship is not purely extractive. African leaders and policymakers have their own agendas, and many are learning how to navigate the space between great powers. The key question is whether African societies—not just elites—are involved in shaping that engagement. That’s where agency really matters.

There’s also a broader philosophical divergence. China’s approach to security and development is rooted in stability first—suppress disorder, maintain regime continuity, and then pursue economic growth. That model appeals to many African governments, but it can conflict with rights-based or participatory governance models.

Over the next decade, we’ll see how that tension plays out—and whether African actors can push for an engagement model that reflects their own values and long-term interests rather than simply accommodating Beijing’s.

Lungani Hlongwa is the South Africa-based editor of the China-Africa Security Radar newsletter and Paul Nantulya is a Research Associate the Africa Center for Security Studies in Washington, D.C.