This is a free preview of the upcoming Africa EVs Weekly Digest, part of the new CGSP Intelligence service launching in Summer 2025.

China’s rapid expansion of electric vehicle (EV) ownership highlights significant gaps in the auto-insurance sector, offering critical lessons for African countries that are scaling up EV adoption and importing or assembling Chinese EV technology.

Although EV owners pay higher premiums than gasoline cars, insurers are still losing money with China’s combined underwriting ratio for EV insurance now above 100%. This means payouts and expenses exceed premiums.

Insurers in African countries could face similar losses if they use outdated models, underprice premiums, or ignore differences in driver behavior, road conditions, or parts availability.

Still, this week’s activities show that EV adoption will continue, with even a South African utility signing a Memorandum of Cooperation (MoC) to increase EV adoption. Partnerships for EV assembly also continue across the continent, with countries like Kenya diversifying the brands they’re working with to expand their offerings to the public transport market.

This week on EVs in Africa:

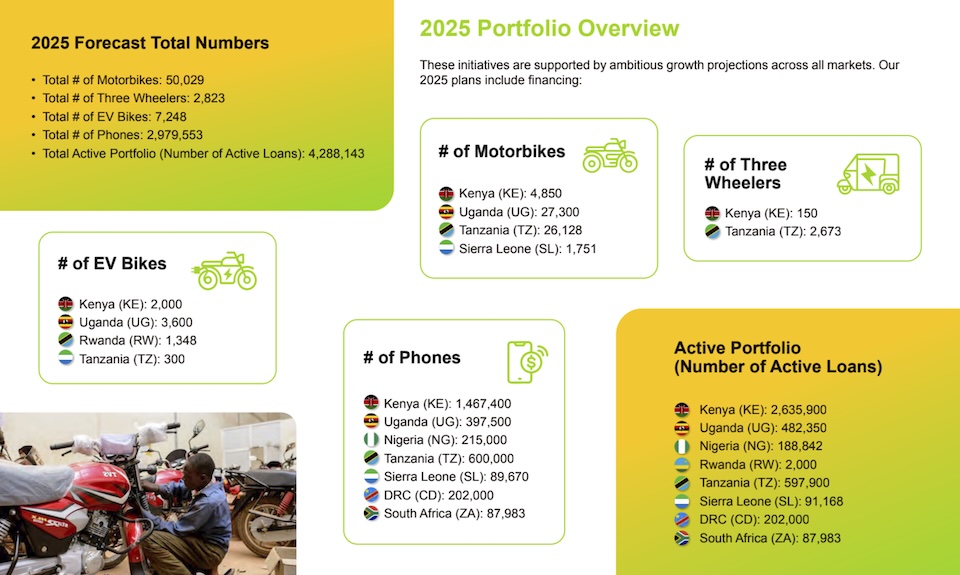

Watu Credit’s Asset Financing Hits Gold for E-Motorcycles in Kenya as Uganda, Tanzania Lag

Watu Credit’s latest report shows that nearly half of its financed motorcycles in Kenya are now electric. By contrast, adoption in neighboring Uganda and Tanzania remains limited, with fewer than 5,000 e-bikes on the road between them.

Why This Matters: The Watu Credit data shows that every country is different when it comes to EV adoption. As such, any solutions meant for users on the continent must be understood based on individual country dynamics to help with adoption and scaling.

Affordable “Premium Features” Driving Chinese EVs Adoption in South Africa

South Africans have been cautious about buying Chinese EVs, but the trend is starting to change. More affordable products with attractive features are driving this shift.

Chinese brands offering consumers features usually reserved for pricier brands are attracting more attention.

Why This Matters: Competition across vehicle segments in South Africa will only become tighter as brands fight to retain or sustain their positions. This means a price war is coming as these brands battle it out for the vehicle buyers.

Plug-in Hybrid BYD Shark 6 Double Cab Launches in Kenya

Loxea and CFAO Mobility Kenya have officially launched the BYD Shark 6 in Nairobi, a plug-in hybrid double-cab truck. Additionally, the dealer formalized a partnership with NCBA Bank for financing solutions.

Loxea brought in the truck a month ago, but it is only now that they’re officially launching it at a public event.

Why This Matters: The official launch coincided with the signing of the partnership agreement with the bank, which creates the impression that financing solutions are available. Since upfront costs for electric vehicles are steep, the partnership with the financial institution could be the key to unlocking and increasing sales.

South Africa’s Eskom Backs Affordable Chinese EV

Eskom signed an MoU with the Chinese EV giant BYD to support affordable and accessible Chinese EVs, positioning cleaner mobility as a viable option for more South Africans. The move aligns with Eskom’s broader efforts to reduce emissions and make transport greener. By backing a Chinese EV model, Eskom is signaling that it sees value in leveraging lower-cost foreign technology to help scale the adoption of electric vehicles nationwide.

Why This Matters: South Africa has a well-established auto industry, and Eskom’s support could help accelerate EV adoption. This could also mean more local production in alignment with the country’s offerings for local assemblers.

BasiGo Partners With China’s King Long Bus Company

With a one-million-kilometer, 10-year CATL battery warranty, BasiGo’s latest partnership shows its commitment to continuing to supply Kenya’s transport sector with reliable e-mobility.

The partnership comes as BasiGo is also assembling vans for passenger transport on intercity routes and building the charging infrastructure along these routes. Like any other business that faces competition, BasiGo continues to innovate solutions that resonate with Kenya’s public transport sector.

Why This Matters: The additional bus brand from King Long could also be driven by a need for diversification and higher-capacity buses. Since there is a dedicated assembly line for the buses, this will also reduce customer wait times.

In Context

Chinese EVs’ rapid ownership exposes weaknesses in its auto-insurance sector, which will trickle down to African nations whose market is still in its infancy. But there are clear lessons- that outdated insurance models could leave local insurers exposed to similar financial strain.

This comes as momentum for EV adoption continues in Africa, with the endorsement of lower-cost Chinese models to broaden access. Stakeholders are working to ensure sustainability through credit facilities and strategic partnerships.

The takeaway: China’s EV boom is exposing weaknesses in traditional vehicle-insurance models, which offers a clear warning for African countries rapidly adopting EVs. Without adapting insurance, financing, and policy frameworks to local realities, African markets risk similar financial pitfalls despite growing partnerships for affordable EVs.