China is redirecting billions of dollars’ worth of exports into Thailand as new U.S. tariffs make access to the American market more difficult, raising concerns about widening trade deficits and the future of Thai industries.

Thailand could face the highest influx of Chinese goods in a decade, as Washington’s “Trump Tariff” forces Beijing to find new markets.

Analysts warn that U.S. tariffs are diverting trade, redirecting goods bound initially for the U.S. market into other destinations, particularly Southeast Asia.

They estimate that between $1.9–2.4 billion worth of Chinese goods could flow into Thailand over the next three years.

Most will be industrial products such as telecommunications equipment, automobiles, and computers, sectors where Chinese producers are influential.

Pressure on Thailand

Analysts projected that without the tariffs, Thai imports from China would rise from $83.47 billion to $105.63 billion. With the tariffs, the total climbs even higher, to $108.23 billion, pushing Thailand’s trade deficit with China from $46.66 billion to $63.63 billion.

“This will be the highest inflow of Chinese goods in a decade,” Ath said, warning that local industries may struggle to compete.

The surge presents a double challenge for Bangkok. On one hand, cheaper imports could benefit consumers and reduce input costs for manufacturers. On the other hand, domestic producers, particularly small and medium-sized enterprises (SMEs), face growing competition from low-cost Chinese industrial goods.

Analysts urged the Thai government to act quickly by introducing safeguards such as:

- Early-warning systems to monitor import surges.

- Transparent rules of origin to prevent re-routed transshipments, which could trigger U.S. retaliation.

- Higher import standards and quality controls to protect SMEs.

- Industrial adjustment funds to help local firms compete.

Failure to act risks leaving Thailand vulnerable to structural dependence on Chinese goods while also exposing it to U.S. penalties if transshipment is detected.

Wider U.S. Tariff Impact

Thailand is also directly affected by Washington’s tariff policy as the U.S. has imposed a 19% duty on Thai goods, with a 25% tariff on automobiles and parts, effective since August 7.

Danucha Pichayanan, Secretary-General of Thailand’s National Economic and Social Development Council (NESDC), cautioned that U.S. measures could weigh heavily on the Thai economy in the second half of 2025.

He pointed to three key risks:

- Falling demand for Thai exports as U.S. consumers face higher prices.

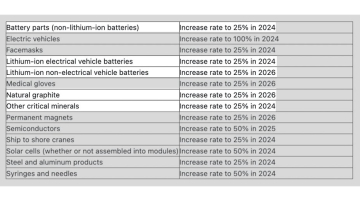

- Global supply chain disruptions are particularly prevalent in intermediate goods like auto parts, chemicals, and semiconductors.

- Rising vulnerability to transshipment scrutiny, with the U.S. threatening tariffs of up to 40% on suspect goods.

Deputy Prime Minister and Finance Minister Pichai Chunhavajira said Bangkok is negotiating with Washington on local content requirements but warned the process is delicate.

“The U.S. wants to bring all production back home, but that is not possible in every case. We understand this, but there is little we can say,” he noted.

Over the past two decades, China’s exports to the U.S. rose from $200 billion (2006) to $500 billion (2024).

The U.S. trade deficit with China peaked at $400 billion in 2018, narrowing to $290 billion in 2024, but it remains a political flashpoint.