Halting food and fuel imports from the United States will not negatively affect China’s food and energy security, a senior Chinese official said on Monday. Zhao Chenxin, deputy head of the National Development and Reform Commission, said China has sufficiently diversified its imports that a freeze in U.S. trade won’t affect it.

Energy and agricultural products are among the U.S.’s largest exports to China. “These products are highly replaceable, and the international market has abundant supplies,” Zhao said.

Meanwhile, China’s Politburo announced support for firms and workers affected by the tariffs on Friday, but held back on additional stimulus spending. At present, the government seems to be waiting out the situation, betting that Trump will roll back tariffs, while it also builds up nationalist support for Chinese President Xi Jinping via intensive messaging.

On Monday, Chinese Foreign Ministry spokesperson Guo Jiakun dismissed Trump’s assertion last week that Xi “has called” to discuss a trade deal. “Let me make it clear one more time that China and the U.S. are not engaged in any consultation or negotiation on tariffs,” he said.

SNAPSHOT: How China is Responding to Tariffs

- PORK: China canceled an order for 12,300 tons of U.S. pork last week, triggering a scramble to find an alternative market, according to the U.S. Meat Export Federation. The U.S. Department of Agriculture said it is the largest cancellation since May 2020, the initial phase of the COVID crisis. South American producers are likely to benefit from the shift.

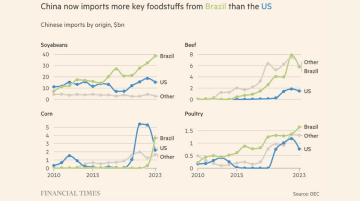

- BEEF: U.S. beef producers face $4 billion in losses this year as China shifts its buying to South America. Beijing is adding additional pressure by delaying the renewal of registrations for 400 U.S. beef processing facilities, making the majority of U.S. beef exports ineligible for the Chinese market.

- SOYBEANS: About 40 ships loaded with Brazilian soybeans are scheduled to arrive at China’s Ningbo Zhoushan port this month, a 48% year-on-year increase. Imports from Brazil, Argentina and Uruguay will increase by 30 million tons over the next three months

Meanwhile, the sharp increase in Chinese imports of soybeans is also hitting U.S. companies working in Brazil. The agribusiness giant Cargill said a lack of soybean supplies could cause it to halt plans to expand its oilseed crushing capacity in Brazil, hitting its soybean oil, meal, and soybean-based biofuels businesses.