The Zambian government, according to Reuters, says it’s doing “everything possible” to avoid defaulting on billions of dollars of Eurobonds, including acceding to investor demands that it reveal the extent of its Chinese loan portfolio. “We’ve given all the information that needs to be given concerning the Chinese debt,” said Finance Minister Bwalya Ng’andu.

But sources close to the Zambia External Bondholder Committee that owns around 40% of the country’s bonds told Reuters that is not accurate. “Creditors have not received detailed information on the Chinese debt,” said the unnamed source.

With only three days left before bondholders hold a critical vote on whether to grant the Zambian government a six-month repayment holiday on about $3 billion of Eurobond notes, President Edgar Lungu (photo) is fast running out of time to come up with a solution.

Lusaka already missed a $42.5 million bond payment that was due last month and if the bondholder committee rejects the government’s request on Friday, Saturday will see Zambia becoming the first African country this year to default on a portion of its debt.

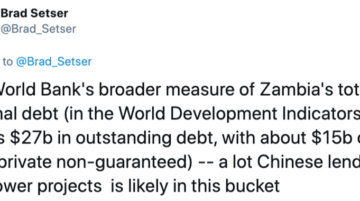

Private creditors have been complaining for months that the government has not been sufficiently transparent about the extent of its debts to China. Investors are worried that funds from any repayment moratorium will be shuttled to Chinese creditors instead

China, for its part, claims that it’s actively trying to find a solution to the debt crisis in Zambia and is committed to the principle of “equal treatment for creditors,” according to a pair of Tweets from Wu Peng, China’s top diplomat for sub-Saharan Africa. Other than those brief comments, neither the Chinese embassy or the Foreign Ministry in Beijing have provided additional details.

The only other movement we’ve seen in recent weeks came from the China Development Bank, which granted a six-month delay in repaying a single loan whose size and terms remain unknown.

Read the exclusive report by Reuters correspondent Joe Bavier.