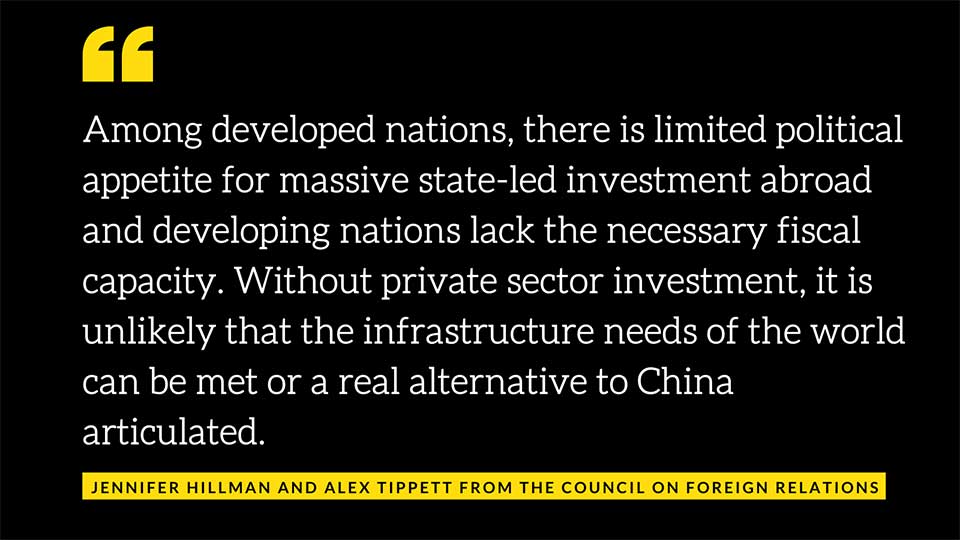

If the proposed B3W has any chance of rivaling China’s eight-year-old Belt and Road Initiative, the U.S. government is going to have to persuade development finance institutions, private companies, and Wall Street that building infrastructure in some of the world’s highest risk countries is a good investment.

Access to huge pools of private capital will be the defining difference between the U.S. approach and China’s state-led initiative that, until now, has largely relied on the country’s two main policy banks, the China Exim Bank and the China Development Bank to fund hundreds of billions worth of infrastructure development throughout the Global South.