In 2023, Honduras severed ties with Taiwan and recognized China, betting that access to one of the world’s largest markets would bring new prosperity. The move was hailed by President Xiomara Castro’s government as a strategic step toward bigger trade deals and deeper economic cooperation.

But two years later, one of the country’s most important export sectors — the shrimp industry — is in crisis. Once a regional powerhouse and Taiwan’s top Central American supplier, Honduran shrimp farms have seen sales collapse, processing plants close, and thousands of jobs vanish. The shift that promised opportunity has instead exposed the risks of pivoting to Beijing without a clear plan for what comes next.

At the time of the diplomatic switch, the logic seemed sound. By adhering to the “One China” policy, Honduras stood to gain access to 1.4 billion potential consumers, far outweighing Taiwan’s population of 23 million. For Taiwan, this was a major setback: it was losing yet another diplomatic ally in Central America. Taiwanese Foreign Minister Joseph Wu claimed at the time that Tegucigalpa broke ties with Taipei because Honduras had sought $2.4 billion in aid, including the construction of a hospital and a dam, as well as debt forgiveness — requests that Taiwan could not meet.

The shrimp industry’s reliance on Taiwan ran deep. Since the 1990s, shrimp farming has been a cornerstone of the Honduran economy, providing significant revenue and jobs. In 2008, a free trade agreement between Taipei and Tegucigalpa boosted the sector, with annual exports to Taiwan reaching about $100 million — roughly 40% of all Honduran shrimp exports.

Honduras’ diplomatic switch and the end of the free trade agreement led to a significant decrease in these exports to Taiwan. In 2024, shrimp exports plummeted 67%, leaving only $25 million in revenue. More than 60 companies, including two processing plants, have closed down their businesses. This has also resulted in the loss of 14,000 jobs.

China was expected to fill the gap and then some, but purchases have fallen short and the prices offered by Chinese buyers are lower than those of Taiwan, affecting the profitability of a sector that accounts for 2% of Honduras’ economy and supports close to 150,000 jobs. Most importantly, Taiwan was not just the primary market for Honduran shrimp — it also provided technical expertise for shrimp farming in the country, a loss felt throughout the industry.

In Honduras, these developments have been met with an increasingly hostile narrative against Beijing, accusing China of making empty promises. For its part, China has tried to help the Honduran shrimp industry by granting tariff-free access to its markets in 2024 under an early harvest agreement, but results have been disappointing. Of 250 shrimp containers exported that year, only one was purchased by China—a snub the head of the National Association of Aquaculturists of Honduras called “unpleasant and rude.”

Recently, two Chinese state-owned companies signed deals in order to significantly increase the consumption of Honduran shrimp to 3,000 tons. Although significant, the figure still falls short of Taiwan’s purchases even after the break in ties this number does not compare to the current level of sales to Taiwan – 4,200 tons in 2024, down from an average of 11,000 tons before.

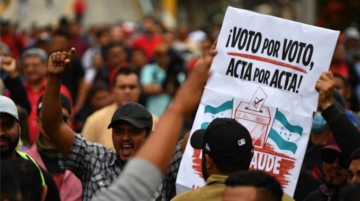

In a presidential election year, these developments have not been ignored in Honduras. The incumbent party is standing by its decision to establish ties with Beijing while also reengaging with Taipei to explore other possibilities and support for the shrimp sector. The opposition has seized on the industry’s collapse to argue for restoring relations with Taiwan and pulling away from China.

The case of the Honduran shrimp industry offers a clear lesson for Global South countries: access to China’s vast market offers potential rewards, but it is not a shortcut to success. Without careful planning, market analysis, and strategic follow-through, the risks can outweigh the gains. Honduras’s shrimp sector is now living proof that when it comes to Beijing, numbers alone are not enough. Strategy matters.

Alonso Illueca is CGSP’s Non-Resident Fellow for Latin America and the Caribbean.