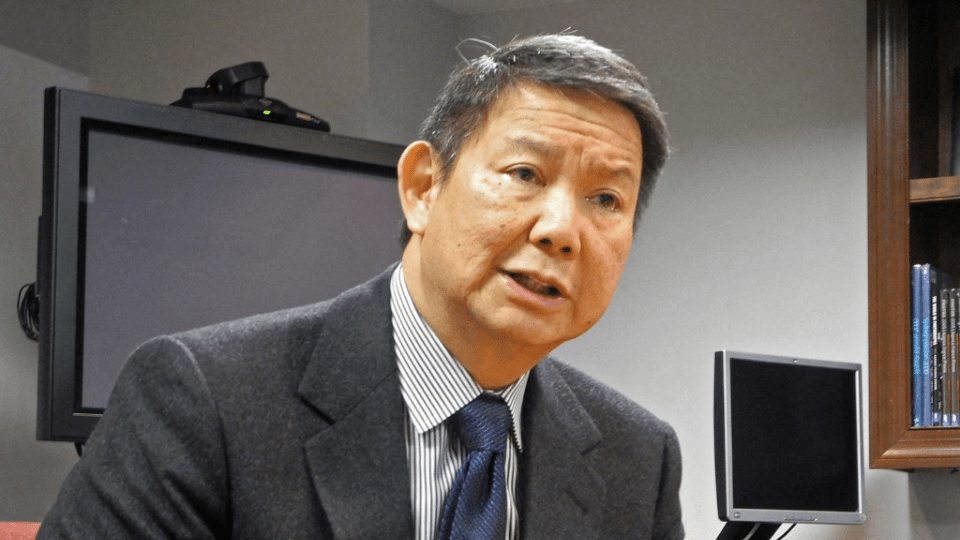

Indonesia is preparing to launch its first nuclear energy program. This landmark shift could redefine Southeast Asia’s clean energy trajectory or expose the country to new geopolitical and environmental risks.

The plan, unveiled by President Prabowo Subianto’s energy envoy Hashim Djojohadikusumo, includes a target of 10 gigawatts (GW) of nuclear capacity by 2040, part of a broader strategy to add 103 GW of new power infrastructure in just 15 years.

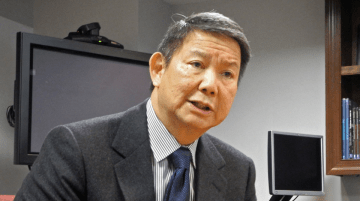

“Many of the contracts will be … in the next five years … especially the nuclear [contracts] because of the long lead times,” Hashim said in an interview from New York this week.

The new capacity would include 75 GW from solar, wind, geothermal, and biomass, 10 GW from nuclear, and 18 GW from gas. Indonesia’s current installed power capacity stands at around 90 GW, more than half of which comes from coal.

While renewables comprise less than 15 GW of current capacity, the government’s push aims to pivot away from fossil fuels, but not completely. “The government does not want to commit economic suicide. There’ll be no phase out, but there will be a phase down,” Hashim said.

China Eyeing Indonesia’s Nuclear Energy Ambition

Several global energy giants, including China National Nuclear Corporation (CNNC), are eyeing Indonesia’s nuclear ambitions, especially in Indonesia’s exploration of small modular reactors (SMRs).

China has invested around US$35 billion in Indonesia over the past 17 years, with 25% directed to clean energy, such as solar and hydropower. China also dominates Indonesia’s nickel industry, which is crucial for the EV battery supply chain.

“I think it’s conceivable that they will co-invest with an institution like Danantara,” he said, referring to Danantara Indonesia, the country’s recently launched sovereign wealth fund.

JETP Faces Delays as U.S. Withdrawal Casts Shadow on Transition

Indonesia’s goal for carbon neutrality by 2050 faces setbacks, particularly after the U.S. quietly withdrew from the Just Energy Transition Partnership (JETP) in April 2025.

Indonesia is set to retire the 660 MW Cirebon-1 coal plant early, with a deal confirmed through the Asian Development Bank. Hashim said the closure is expected in the coming months despite legal and financial concerns.

In the vacuum left by slow-moving Western climate finance, Indonesia is turning to a mix of public-private partnerships and international suppliers.

Yet nuclear development in Indonesia remains deeply controversial. The archipelago sits along the Pacific Ring of Fire, one of the world’s most seismically active regions.

Floating Reactors and Western Indonesia Sites Under Consideration

Hashim acknowledged that no location has been chosen yet, but said the western part of the country is more suitable for large, single-site plants generating around 1 GW. At the same time, smaller floating modular reactors of up to 700 MW could be deployed in eastern Indonesia.

Indonesia’s move is the latest in Asia, where nine countries already operate nuclear power plants, to revisit atomic energy as a route to energy security and climate goals.

Experts warn that regulatory readiness, environmental safeguards, and public consent will be critical. Funding gaps, safety questions, and geopolitical maneuvering all shadow Jakarta’s nuclear vision.

Still, the ambition is clear. As Hashim put it, “especially the nuclear [contracts]” will be decided soon, and they could reshape not just Indonesia, but energy geopolitics across the region